The World Nuclear Industry Status Report 2020 (HTML)

By

Mycle Schneider

Independent Consultant, Paris, France

Project Coordinator and Lead Author

Antony Froggatt

Independent Consultant, London, U.K.

Lead Author

With

Julie Hazemann

Director of EnerWebWatch, Paris, France

Documentary Research, Modelling and Datavisualization

Ali Ahmad

Research Fellow, Project on Managing the Atom

and International Security Program (ISP),

Harvard Kennedy School, U.S.

Contributing Author

Tadahiro Katsuta

Professor, School of Law, Meiji University,

Tokyo, Japan

Contributing Author

M.V. Ramana

Simons Chair in Disarmament, Global and Human Security with the Liu Institute for Global Issues at the University of British Columbia,

Vancouver, Canada

Contributing Author

Ben Wealer

Research Associate, Workgroup for Economic and Infrastructure Policy, Berlin University of Technology (TU Berlin), Germany

Contributing Author

Agnès Stienne

Artist, Graphic Designer, Cartographer,

Le Mans, France

Graphic Design & Layout

Friedhelm Meinass

Visual Artist, Painter, Rodgau, Germany

Cover-page Design, Painting and Layout

Foreword by

Jungmin Kang

Former Chair, Nuclear Safety & Security Commission, South Korea

Frank von Hippel

Professor Emeritus, Princeton University, U.S.

Paris, September 2020 © A Mycle Schneider Consulting Project

A difficult year. For so many people around the globe. Everything seems to be slower, needing more effort, as our attention and energy is often deviated towards statistics on COVID-19 cases, deaths and combat strategies. Behind the numbers are people. It is not only that the many human lives were lost, it is also many people that contracted the illness that have to cope with long-term health effects. Not to talk about the devastating social effects, many of which are yet to unfold.

The project coordinator is therefore particularly thankful to everyone who made the production of this year’s report possible, the authors and data-manager, the designers and artists, the webmaster and all the supporters.

As for so many years now, a big thank you to Antony Froggatt for his conceptual ideas, his contributions, his reactivity and his friendship.

At the core of the World Nuclear Industry Status Report (WNISR) is its database, designed and maintained by data manager and information engineer Julie Hazemann, who also develops most of the drafts for the graphical illustrations and manages much of the cooperation with designer and webmaster. She expanded her contribution significantly over the past two years. As ever, no WNISR without her. Thanks so much.

The WNISR project can solidly count on the regular, reliable, professional and insightful contributions from M.V. Ramana, Tadahiro Katsuta and Ben Wealer. Many thanks to all of you.

WNISR2020 greatly profits from a wonderful new contributing author, Ali Ahmad. We are very grateful for his excellent input.

We were lucky to have two outstanding top nuclear policy experts, Frank von Hippel and Jungmin Kang, providing a generous, lucid foreword that puts the WNISR work into broader context. Thanks a million.

Many other people have contributed pieces of work to make this project possible and to bring it to the current standard. In particular Shaun Burnie, whose multiple contributions again have been invaluable and are highly appreciated. Thank you also to Caroline Peachey, Nuclear Engineering International, for providing the load factor figures quoted throughout the report.

Artist and graphic designer Agnès Stienne created the redesigned layout in 2017 and is constantly improving our graphic illustrations that get a lot of praise around the world. Thank you.

Nina Schneider put her meticulous proof-reading and production skills to work again and added some helpful research.

Thanks so much.

A big thank-you to Arnaud Martin for his continuous, highly reactive and reliable work on the website, dedicated to the WNISR: www.WorldNuclearReport.org.

For the second time, we owe the idea, design, and realization of the cover to renowned German painter Friedhelm Meinass, and designer Constantin E. Breuer, (“who congenially implements his ideas”) and who have also contributed the acclaimed original artwork for the WNISR2019 cover. Thanks so much for this brilliant, thoughtful and very generous contribution.

This work has greatly benefitted from additional proofreading by Walt Patterson, partial proof-reading, editing suggestions, comments or other input by Pinar Demircan, Anton Eberhard, Jan Haverkamp, Christian von Hirschhausen, Gregory Jaczko, Daul Jang, Lutz Mez, Olexi Pasyuk, Steve Thomas, and others. Thank you all.

The authors wish to thank in particular Matthew McKinzie, Eva van de Rakt, Tanja Gaudian, Rainer Griesshammer, Andrea Droste, Rebecca Harms, Jutta Paulus and Simon Banholzer for their enthusiastic and lasting support of this project.

And everybody involved is grateful to the MacArthur Foundation, Natural Resources Defense Council, Heinrich Böll Foundation, the Greens-EFA Group in the European Parliament, Elektrizitätswerke Schönau, Foundation Zukunftserbe and the Swiss Renewable Energy Foundation for their generous support.

Note

This report contains a very large amount of factual and numerical data. While we do our utmost to verify and double-check, nobody is perfect. The authors are always grateful for corrections and suggested improvements.

Lead Authors’ Contact Information

Mycle Schneider

45, Allée des deux cèdres

91210 Draveil (Paris)

France

Ph: +33-1-69 83 23 79

mycle@WorldNuclearReport.org

Antony Froggatt

53a Neville Road

London N16 8SW

United Kingdom

Ph: +44-79 68 80 52 99

antony@froggatt.net

Table of contents

Executive Summary and Conclusions

Production and Role of Nuclear Power

Operation, Power Generation, Age Distribution

Construction Starts & Cancellations

Nuclear Power in the Age of COVID-19

Decommissioning Status Report 2020

Nuclear Power vs. Renewable Energy Deployment

Annex 1 - Overview by Region and Country

Annex 2 - Status of Canadian Nuclear Fleet

Annex 3 - Status of Japanese Nuclear Fleet

Annex 4 - Status of Nuclear Power in the World

Annex 5 - Nuclear Reactors in the World “Under Construction”

Table of Figures

Figure 1 · Nuclear Electricity Generation in the World... and China

Figure 2 · Nuclear Electricity Generation and Share in Global Power Generation

Figure 3 · Nuclear Power Reactor Grid Connections and Closures in the World

Figure 4 · Nuclear Power Reactor Grid Connections and Closures – The Slowing China Effect

Figure 5 · World Nuclear Reactor Fleet, 1954–2020

Figure 6 · Nuclear Reactors “Under Construction” in the World (as of 1 July 2020)

Figure 7 · Average Annual Construction Times in the World

Figure 8 · Delays for Units Started Up 2018–2019

Figure 9 · Construction Starts in the World

Figure 10 · Construction Starts in the World/China

Figure 11 · Cancelled or Suspended Reactor Constructions

Figure 12 · Age Distribution of Operating Reactors in the World

Figure 13 · Reactor-Fleet Age of Top 5 Nuclear Generators

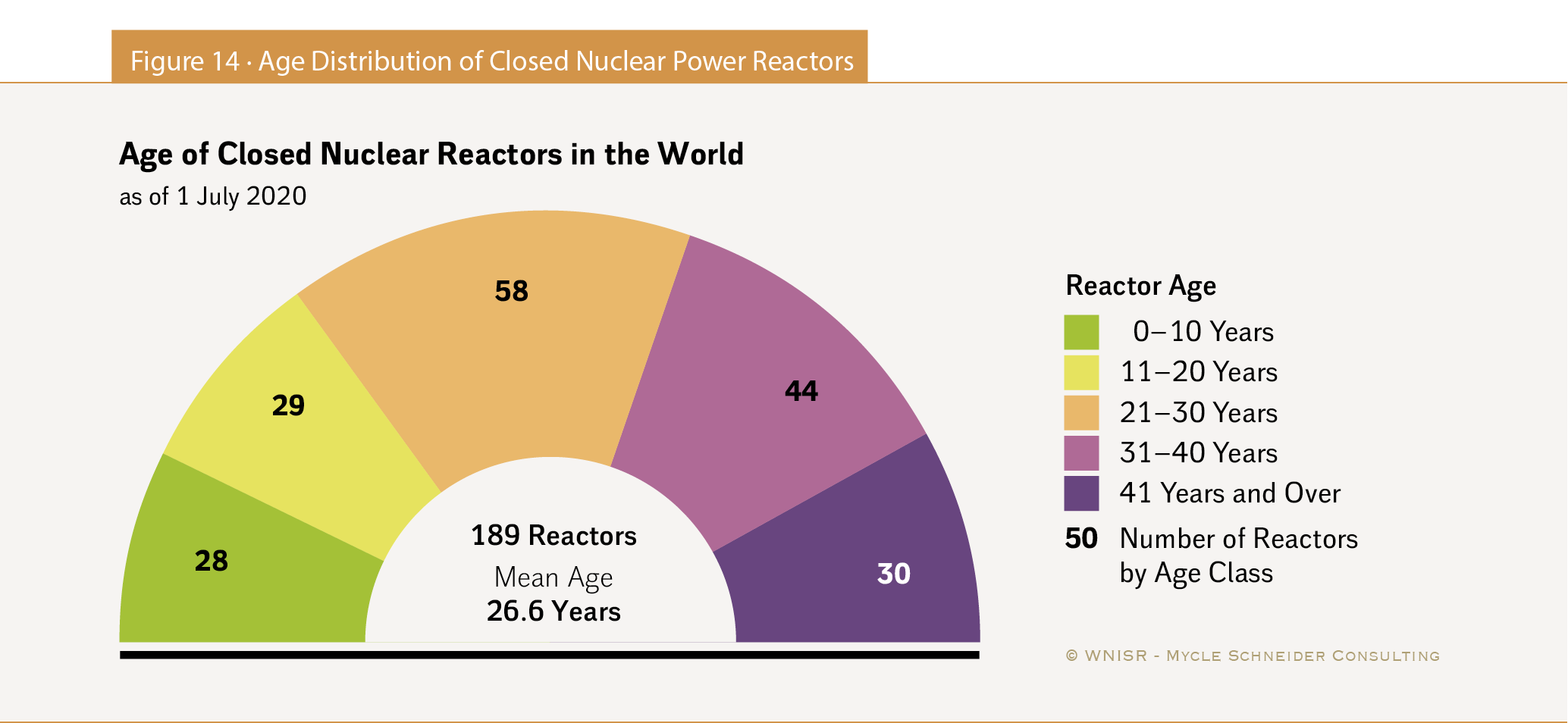

Figure 14 · Age Distribution of Closed Nuclear Power Reactors

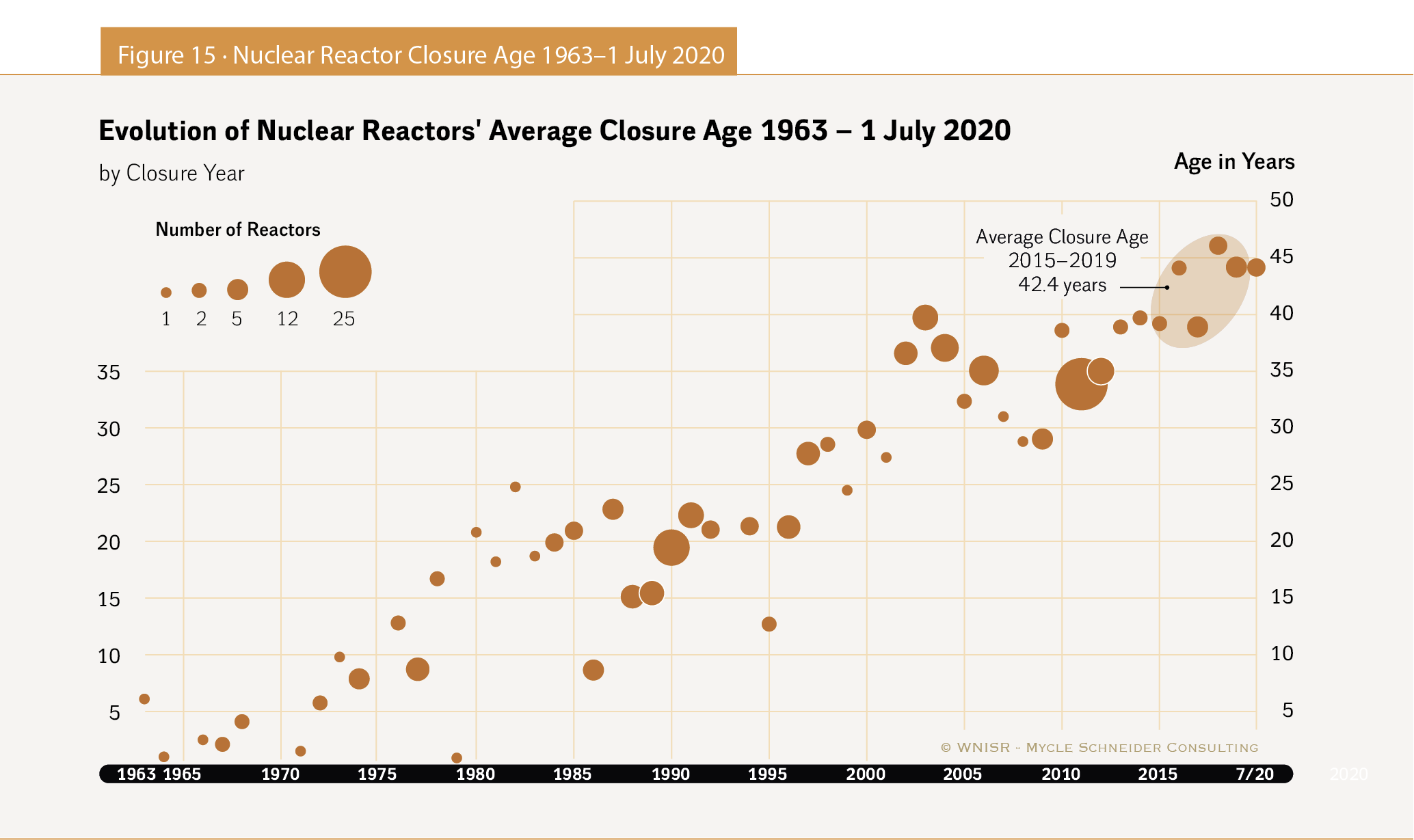

Figure 15 · Nuclear Reactor Closure Age 1963–1 July 2020

Figure 16 · The 40-Year Lifetime Projection

Figure 17 · The PLEX Projection (not including LTOs)

Figure 18 · Forty-Year Lifetime Projection versus PLEX Projection

Figure 19 · “All Necessary Measures”? — No masks.

Figure 20 · Rosatom’s DG Presenting a Weekly Overview of COVID-19 Cases at Rosatom

Figure 21 · Canteens at Hinkley Point C – Before and After Social Distancing

Figure 22 · Travel Trailers at the Cook Nuclear Plant—Just in Case

Figure 23 · Overview of the Status of Nuclear Power Programs in the Middle East

Figure 24 · Timelines of Nuclear Power Reactors in the Middle East

Figure 26 · Public Opinion in Turkey on Nuclear Power

Figure 27 · Comparative Cost of Electricity in Jordan

Figure 28 · Iran’s 2019 Nominal Electricity Generating Capacity (by Source)

Figure 29 · Share of Natural gas in Power Generation in Selected Regional Countries in 2019

Figure 30 · Comparative Costs of Nuclear and Solar PV Projects in the Middle East

Figure 31 · Egypt’s Electricity Generation Mix Projections for 2022 and 2035

Figure 32 · Operating Fleet and Capacity in France (as of 1 July 2020)

Figure 33 · Startups and Closures in France

Figure 34 · Reactor Outages in France in 2019 (in number of units and GWe)

Figure 35 · Forced and Planned Unavailability of Nuclear Reactors in France in 2019

Figure 36 · Scheduled vs. Realized Unavailability of Nuclear Reactors in France in 2019

Figure 37 · Age Distribution of the French Nuclear Fleet (by Decade)

Figure 38 · Rise and Fall of the Japanese Nuclear Program

Figure 39 · Status of the Japanese Reactor Fleet

Figure 40 · Age Distribution of the Japanese Nuclear Fleet

Figure 41 · Age Distribution of the U.K. Nuclear Fleet

Figure 42 · The Hinkley Point C Construction Site

Figure 43 · Age Distribution of the U.S. Nuclear Fleet

Figure 44 · Timelines of Early Retirement in the United States

Figure 46 · Overview of Completed Reactor Decommissioning Projects, 1953–2020

Figure 47 · Progress and Status of Reactor Decommissioning

Figure 48 · Global Investment Decisions in Renewables and Nuclear Power, 2004–2019

Figure 49 · Regional Breakdown of Nuclear and Renewable Energy Investment Decisions 2010–2019

Figure 50 · The Declining Costs of Renewables vs. Traditional Power Sources

Figure 51 · Variation of Wind, Solar and Nuclear Capacity and Electricity Production in the World

Figure 52 · Net Added Electricity Generation by Power Source 2009–2019

Figure 53 · Wind, Solar and Nuclear Installed Capacity and Electricity Production in the World

Figure 54 · Non-Hydro Renewables and Nuclear Electricity Production in the World

Figure 55 · Nuclear vs Non-Hydro Renewables in China 2000–2019

Figure 56 · Installed Wind, Solar and Nuclear Capacity and Electricity Production in China 2000–2019

Figure 57 · Renewable Energy and Nuclear Power Generation in the EU28, 2010–2019

Figure 58 · Wind, Solar and Nuclear Capacity and Electricity Production in the EU28 (Developments)

Figure 60 · Wind, Solar and Nuclear Installed Capacity and Electricity Production in India

Figure 61 · Wind, Solar and Nuclear Installed Capacity and Electricity Production in the U.S

Figure 62 · Nuclear Reactors Startups and Closures in the EU27 1959–1 July 2020

Figure 63 · Nuclear Reactors and Net Operating Capacity in the EU27

Figure 64 · Age Distribution of the EU27 Reactor Fleet

Figure 65 · Age Distribution of the Western European Reactor Fleet (incl. Switzerland and the U.K.)

Figure 66 · Main Developments of the German Power System Between 2010 and 2019

Table 1 · Nuclear Reactors “Under Construction” (as of 1 July 2020)

Table 2 · Duration from Construction Start to Grid Connection 2010–2019

Table 3 · Typology of Nuclear Power Programs in the Middle East

Table 4 · Nuclear Technology Suppliers in the Middle East

Table 5 · Overview of the costs of nuclear power projects in the Middle East and economic indicators

Table 6 · Jordan’s SMR agreements (as of May 2020)

Table 7 · Official Reactor Closures Post-3/11 in Japan (as of 1 July 2020)

Table 8 · Status of Nuclear Reactor Fleet in South Korea (with scheduled closure dates)

Table 9 · 15 Early-Retirements for U.S. Reactors 2009–2025

Table 10 · U.S. State Emission Credits for Uneconomic Nuclear Reactors 2016–2019 (as of 1 July 2020)

Table 11 · Fukushima Decommissioning: Evolution of the Medium- and Long-Term Roadmap

Table 12 · Status of Reactor Decommissioning in the U.S. (as of May 2020)

Table 13 · Overview of Outsourcing of U.S. Decommissioning Projects

Table 14 · Status of Reactor Decommissioning in France (as of May 2020)

Table 15 · Status of Reactor Decommissioning in Germany (as of May 2020)

Table 16 · Overview of reactor decommissioning in 11 selected countries (as of May 2020)

Table 17 · Vendor Design Review Service Agreements in Force Between Vendors and the CNSC

Table 18 · Vendor Design Review Service Agreement Between Vendors and the CNSC Under Development

Table 19 · Scheduled Closure Dates for Nuclear Reactors in Taiwan 2018–2025

Table 20 · Status of Belgian Nuclear Fleet (as of 1 July 2020)

Table 21 · Legal Closure Dates for German Nuclear Reactors 2011–2022

Table 22 · Status of Canadian Nuclear Fleet - PLEX and Expected Closure

Table 23 · Status of Japanese Nuclear Reactor Fleet (as of 1 July 2020)

Table 24 · Status of Nuclear Power in the World (as of 1 July 2020)

Table 25 · Nuclear Reactors in the World “Under Construction” (as of 1 July 2020)

By Frank von Hippel & Jungmin Kang1

The World Nuclear Industry Status Report (WNISR) has become an invaluable resource for those interested in trends in nuclear power globally and in a more detailed understanding of developments in particular countries.

As this report makes clear, globally, nuclear power continues to be in stasis. In Western Europe and the United States (U.S.), the rate of retirements is increasing while the few new construction projects have had catastrophic cost overruns and schedule slippages.

In the U.S., Westinghouse – once the world’s leading designer of nuclear power plants – went bankrupt in 2017 as a result of the huge cost overruns and schedule delays that resulted in the termination of construction on two AP1000 reactors in South Carolina and a continuing controversy over the construction of another two in Georgia. These fiascos have foreclosed for the foreseeable future construction of new conventional 1000+ MWe nuclear power plants in the United States.

After providing loan guarantees totaling US$12 billion for the Georgia plant, the U.S. Department of Energy, has pivoted to support the development of a variety of “small modular reactors” (SMRs) with individual unit outputs ranging from tens to hundreds of megawatts. A few may be bought by the government to provide power to large government installations such as army and navy bases and national nuclear laboratories but, as WNISR2020 concludes, “there is no need to wait with bated breath for SMRs to be deployed” on a large scale.

In Japan, almost a decade after the Fukushima accident, nuclear utilities continue to struggle to meet the new regulatory requirements – typically pouring more than one billion dollars into safety upgrades per reactor while struggling to reassure host communities and prefectures.

China continues to grow its nuclear capacity but at a slowing rate and Russia’s government continues to finance Rosatom’s aggressive export of nuclear power plants to new nuclear countries.

In South Korea, as in China, the cost of constructing new nuclear power plants has been kept under better control than in West Europe and the United States. The Fukushima accidents and falsification of safety certificates in South Korea’s nuclear industry turned a large fraction of the population against nuclear power, however, and the Moon Administration banned the construction of new nuclear power plants after Shin Kori-6.2 New nuclear power plant construction could find a more sympathetic ear in the Blue House3, however, if the conservatives come back to power in the presidential election of 2022.

Under a US$20 billion deal with the United Arab Emirates (UAE), four South Korean-designed APR1400 reactors are being built at Barakah by a consortium led by the Korea Electric Power Corporation. The project has not gone smoothly, however. Barakah-1 began feeding power into UAE’s grid in August 2020, three years later than originally projected and concrete “voids” and “cracks” were found in the containment buildings of Unit 2 and Unit 3 in 2018.4 As described in WNISR2020, similar faults of containment buildings have raised significant safety issues for a number of nuclear power plants in South Korea. In part, these defects reflect inadequate inspections by safety regulators when the containments were built. China, which is still developing its nuclear regulatory regime, should take note.

UAE’s long-term energy plan does not include any additional nuclear capacity, at least before 2050. South Korea is cooperating on nuclear energy with Saudi Arabia but, will not be able to sell APR1400s there unless Saudi Arabia concludes a so-called 123 Agreement for Cooperation on Peaceful Uses of Atomic Energy with the United States.

Overall, in terms of the cost of power, new nuclear is clearly losing to wind and photovoltaics. As WNISR2020 shows, investment in new nuclear is about one tenth that in wind and photovoltaics (Figure 49). The high capital cost of nuclear power plants requires that they operate almost continually to bring down the capital charge per kilowatt-hour. They must therefore compete directly with renewables most of the time or store their output to be used during cloudy, windless periods. Storage does not relieve the competition with wind and solar, however, because, as renewables expand and storage costs come down, they too will have increasing incentives to store their excess output.

The biggest social argument for nuclear powerplants is that their carbon emissions are low. Currently, existing nuclear power plants are usefully producing a little less than one third of global low-carbon-emission electric power. Increasingly, therefore, the issue is not one of nuclear new-builds but nuclear life extension. Even there, however, nuclear is struggling. As WNISR2020 makes convincingly evident, in some major countries such as the United States, even 30-year-old plants whose capital costs have been paid off cannot compete economically with new renewable power plants, whose capital costs have been declining. The operating costs of nuclear plants are high in part because one to two hundred workers and guards are required on site per reactor at all times in case of accident or terrorist attack. Subsidies justified by their low carbon emissions have become critical to the continued operation of many U.S. nuclear power plants.

A recent event in South Korea has, however, raised concerns about sudden shutdowns in nuclear power plants as a result of the extreme weather events that are becoming more frequent as a result of climate change. On 3 September 2020, South Korea’s Nuclear Safety and Security Commission announced that four reactors at Kori Nuclear Power Plant had shut down automatically early that morning because of typhoon impacts on their power transmission lines. Prior to the shutdown, the four reactors had been providing about 7 percent of the country’s total power generation. Experts are concerned that, under different circumstances, the sudden shutdowns could destabilize South Korea’s grid and cause large-scale blackouts.5

What about the arguments for phasing out fission faster than will happen naturally as retirements exceed new builds? From our perspective, the most important consideration is nuclear-weapon proliferation. Nuclear war remains an existential danger to civilization, comparable to the destabilizing dangers of climate change. The difference is that, while we can see climate change happening gradually, nuclear war could come upon us suddenly, by surprise, as a result of some terrible mistake, hacking or a deranged leader. The proliferation of nuclear weapons to more countries increases the probability of such events.

Historically, the nuclear energy community’s early infatuation with plutonium breeder reactors facilitated nuclear weapon programs in France, India, Israel and the United Kingdom. Military dictatorships in Argentina, Brazil, South Korea and Taiwan started down the same track but were delayed by external pressure long enough for anti-nuclear-weapon democratic Governments to take over.

Thanks to the “invisible hand” of economics, the threat of nuclear proliferation and nuclear terrorism from plutonium separation have receded. The capital costs of sodium-cooled plutonium “breeder” reactors are higher than those of light water reactors (LWRs) and using plutonium as fuel in LWRs costs ten times as much as low-enriched uranium fuel. Yet breeder advocates in China, France, India, Japan and Russia still succeed in persuading their gullible Governments to keep plutonium programs alive and, in South Korea and the United States, are even promoting new programs.

The Korea Atomic Energy Research Institute (KAERI) has been campaigning for decades for South Korea’s “right” to reprocess, like Japan. During the renegotiation of the U.S.-ROK Agreement on Peaceful Nuclear Cooperation, the United States managed put the issue off with a 10-year joint “feasibility study”, but that study is to be completed in 2021 and KAERI is starting to press again.

KAERI’s advocacy has centered on its claim that reprocessing will solve the problem of the accumulation of spent fuel in the pools of South Korea’s nuclear power plants. On-site dry-cask storage has dealt with this problem at the Wolsong nuclear power plant whose heavy water reactors filled their pools years ago. Majorities in local communities and nuclear-energy opponents strongly oppose on-site dry-cask storage at other nuclear power plants, however, fearing that the power plants will become permanent storage sites for spent fuel.

Some Government officials and members of the National Assembly also argue that reprocessing could provide a latent nuclear deterrent against North Korea’s nuclear threats. Those voices are much less significant in the Moon Administration than in the opposition but, in politics, nothing is permanent.

In the case of uranium enrichment, the invisible hand has been facilitating proliferation. Enrichment is required by most current-generation nuclear power plants. The advent of low-cost gas centrifuge enrichment plants made small enrichment plants affordable to Brazil, Iran, North Korea and Pakistan. All four sought those plants in order to produce highly enriched uranium for bombs. Fortunately, Brazil and Iran changed their minds, but they could change their minds again and other countries could easily go down the same track.

The only answer to the spread of national enrichment plants is to put enrichment under multinational or international control. The success of URENCO, jointly owned by Germany, the Netherlands and the United Kingdom and owner of 30 percent of global enrichment capacity, shows that multinational enrichment is feasible. The global overcapacity of enrichment – with a resulting price for enrichment services insufficient to pay back the capital costs of new investments even in large plants – shows that there is no economic justification for new national enrichment plants. Hopefully, future issues of WNISR will include discussions of developments relating to reprocessing and enrichment.

The second argument for accelerating the phaseout of nuclear power is nuclear accidents. Unlike nuclear war, these are not civilization-destroying events but, as the Chernobyl and Fukushima accidents have shown, they have long-term consequences that are highly traumatic for society. Witnessing those ordeals was enough to convince Germany and Taiwan to accelerate the phase-outs of their nuclear power capacity and many other countries to cut back or cancel decisions to build new nuclear plants.

We congratulate the authors and editors of WNISR for their objective and in-depth coverage of a very controversial subject. We hope this effort will continue. The nuclear industry will be with us for decades to come. How it evolves will impact the future of international security as well as the future energy supply. It needs watching and we are grateful that WNISR is doing so.

Nuclear Power in the Age of COVID-19

Unprecedented

COVID-19 is the first pandemic directly, significantly impacting the nuclear industry.

Large Outbreaks

Russia’s Rosatom reported about 4,500 infections, France’s EDF about 600 cases. In the U.S., a single reactor site undergoing refueling reported 200–300 infections, and the only nuclear construction site in the country had over 800 cases. Most operators/regulators have not released precise numbers.

Degraded Safety and Security

Many testing, maintenance and repair activities have been canceled or suspended or carried out under improper conditions with social distancing rules in place. The effects of these will only become evident in the months and years to come.

Critical Staff Issues

Particular groups of staff highly trained for a given specific facility (control-room operators, security staff) are difficult to replace. They remain at risk of infection.

Staff Shortages

EDF, for example, put two thirds of its nuclear staff on remote work. Subcontractors complained about lack of onsite oversight, leading to accidental injuries at least in one documented case.

Long Work Hours

The U.S. nuclear regulator, for example, granted operators permission to impose up to 16 work hours in any 24-hour period, up to 86 work hours in any 7-day period and 12-hour shifts up to 14 consecutive days.

Onsite Inspections

by safety authorities were suspended for weeks in several countries.

Economic Crash

Nuclear utilities have been hard hit economically as operational costs went up, while bulk prices dropped as electricity consumption plunged.

World Operating Fleet at 30-Year Low

As of 1 July 2020,

31 countries operated 408 nuclear reactors, a decline of 9 units compared to mid-2019—10 less than in 1989 and 30 fewer than the 2002 peak of 438.

In total, 31 reactors—including 24 in Japan—are in Long-Term Outage (LTO).

3 units closed, not a single unit started up in the first half of 2020.

The total operating nuclear capacity declined by 2.2 percent from one year earlier to reach 362 GW as of mid-2020.

The mean age of the world’s nuclear fleet has increased steadily since 1984 and now stands at about 31 years with 20 percent reaching 41 years or more.

Nuclear energy’s share of global gross electricity generation marked a break in its slow but steady decline from a peak of 17.5 percent in 1996, with a 0.2 percentage-point increase over the 10.15 percent in 2018 to 10.35 percent in 2019.

Russia Drives Global Constructions

Six reactors started up in 2019, three in Russia, two in China, one in South Korea, yet seven less than scheduled at the beginning of the year. Five units were closed.

Russia is involved in 15 of the 52 construction projects in 8 of the 17 countries building.

China Short-Term Driver, Long-Term Enigma

In 2019, nuclear power generation in the world increased by 3.7 percent of which half due to a 19 percent increase in China.

Three units were closed, not a single unit started up in the first half of 2020, including in China.

After declining for 5 years, the number of units under construction increased by 6 to 52 as of mid-2020 (incl. 15 in China) but remains well below the 69 units at the end of 2013.

In 2019, construction began on 6 reactors (incl. 4 in China), and on one in the first half of 2020 (in Turkey).

China will miss its Five-Year-Plan 2020 nuclear targets of 58 GW installed and 30 GW under construction.

China still leads renewable energy investments with US$83 billion.

Global Construction Delays Worsen

At least 33 of the 52 units under construction are behind schedule; 12 have reported increased delays and 4 have had documented delays for the first time over the past year.

In 8 cases (15 percent), first construction starts date back 10 years or more, including two units that had construction starts 35 years ago and one unit that goes back 44 years.

Middle East Focus

Six countries with nuclear power interests: Iran, UAE, Turkey, Egypt, Saudi Arabia and Jordan (by order of program advancement). Natural gas dominates power generation.

One operating reactor (in Iran) generating less than 2 percent of electricity in the country. In addition, Barakah-1 (UAE) started up in August 2020, first reactor in the Arab world.

Six units are under construction, in UAE (3), in Turkey (2) and Iran (1). Five are behind schedule and one just started. At the most, one other construction start could happen over the year in the region (in Egypt).

Comparisons between nuclear and solar options show a large and widening gap. For example, a contract for 1.2 GW of solar power at US$24.2/MWh, signed in 2017 and connected to the grid in 2019, is 5–8 times cheaper than the international cost estimate for nuclear of US$118–192/MWh.

Renewables Continue to Thrive

A new record 184 GW (+20 GW) of non-hydro renewables were added to the world’s power grids in 2019. Wind added 59.2 GW and solar-photovoltaics (PV) 98 GW. These numbers compare to a net 2.4 GW increase for nuclear power.

Total investment in new-renewable electricity exceeded

US$300 billion, ten times the reported global investment decisions for nuclear power.

Over the past decade, levelized cost estimates for utility-scale solar dropped by 89 percent, wind by 70 percent, while nuclear increased by 26 percent.

Executive Summary and Conclusions

The World Nuclear Industry Status Report 2020 (WNISR2020) provides a comprehensive overview of nuclear power plant data, including information on age, operation, production, and construction of reactors. A new focus chapter in this year’s report is Nuclear Power in the Age of COVID-19 that assesses the safety and security implications of operating nuclear facilities in a pandemic and provides a country-by-country overview of available information on staff infections, impacts and measures. Another special focus is the chapter on Nuclear Power in the Middle East that analyses the significance of the first operating nuclear power plant in the Arab world and the status of nuclear programs in five other countries in the region.

The WNISR assesses the status of new-build programs in the 31 nuclear countries (as of mid-2020) as well as in potential newcomer countries. WNISR2020 includes sections on seven Focus Countries representing about two-thirds of the global fleet. The Fukushima Status Report looks at onsite and offsite impacts of the catastrophe that began in 2011. The Decommissioning Status Report provides an overview of the current state of nuclear reactors that have been permanently closed. The chapter on Nuclear Power vs. Renewable Energy offers comparative data on investment, capacity, and generation from nuclear, wind and solar energy around the world. Finally, Annex 1 presents overviews of nuclear power in the countries not covered in the Focus Countries sections.

Startups. At the beginning of 2019, 13 reactors were scheduled for startup during the year; only six made it, three in Russia, two in China and one in South Korea. No new reactor started up worldwide in the first half of 2020, including in China.6

Closures. Five units were closed in 2019, of which two in the U.S., and one each in Germany, Sweden and Switzerland. Eight additional reactors were officially closed in Japan (5), Russia (1), South Korea (1) and Taiwan (1); most of these had not generated power in years.7 In the first half of 2020, three additional units were closed, two in France and one in the U.S.

Operation & Construction Data8

Reactor Operation and Production. As of 1 July 2020, 31 countries operating 408 nuclear reactors—excluding Long-Term Outages (LTOs)—a decline of nine units compared to WNISR20199—10 less than in 1989 and 30 fewer than the 2002 peak of 438. Of the 28 reactors in LTO as of mid-2019, one was restarted, and one was closed; with five units entering the LTO category, there is, as of mid-2020, a total of 31 units in LTO as of mid-2020,10 all considered operating by the International Atomic Energy Agency (IAEA). These include 24 reactors in Japan (no change), three in the U.K., two in South Korea, and one each in China and India.

The total operating capacity declined by 2.1 percent from one year earlier to reach 362 GW as of mid-2020.11

Annual nuclear electricity generation reached 2,657 net terawatt-hours (TWh or billion kilowatt-hours) in 2019, a 3.7 percent increase over the previous year—half of which is due to China’s nuclear output increasing by over 19 percent—and only 3 TWh below the historic peak in 2006.

The “big five” nuclear generating countries—by rank, the United States, France, China, Russia and South Korea—again generated 70 percent of all nuclear electricity in the world in 2019. Two countries, the U.S. and France, accounted for 45 percent of 2019 global nuclear production, that is 2 percentage points lower than in the previous year, as France’s output shrank by 3.5 percent.

Share in Electricity/Energy Mix. Nuclear energy’s share of global commercial gross electricity generation has marked a break in its slow but steady decline from a peak of 17.5 percent in 1996, with a small 0.2 percentage-point increase over the 10.15 percent in 2018 to 10.35 percent in 2019.

Nuclear power’s share of global commercial primary energy consumption has remained stable since 2014 at around 4.3 percent.

Reactor Age. In the absence of major new-build programs apart from China, the average age of the world operating nuclear reactor fleet continues to rise, and by mid-2020 reached 30.7 years. The mean age of the world’s fleet has been increasing since 1984, when it stagnated.

A total of 270 reactors, two-thirds of the world’s operating fleet, have operated for 31 or more years, including 81 (20 percent of the total) that have operated for 41 years or more.

Lifetime Projections. If all currently operating reactors remained on the grid until the end of their licensed lifetime, including many that already hold authorized lifetime extensions (PLEX Projection), and all units under construction scheduled to have started up, an additional 135 reactors or 105 GW (compared to the end-of-2019 status) would have to be started up or restarted prior to the end of 2030 in order to maintain the status quo. This would mean, in the coming decade, the need to more than double the annual building rate the past decade from 5.8 to 13.7. Construction starts are on a declining trend. The required number of new units might be even higher because many reactors are being shut down long before their licenses are terminated; the mean age at closure of the 17 units taken off the grids between 2015 and 2019 was 42.4 years.

Construction. Seventeen countries are currently building nuclear power plants, one more than in mid-2019, as Iran restarted construction of Bushehr-2 site, originally launched in 1976. As of 1 July 2020, 52 reactors were under construction—six more than WNISR reported for mid-2019 but 17 fewer than in 2013—of which 15 in China with 14 GW of capacity, less than half of the 5-Year target of 30 GW under construction by the end of 2020.

Total capacity under construction in the world increased by 8.9 GW to 53.5 GW. The current average time since work started at the 52 units under construction is 7.3 years, on the rise for the past two years from an average of 6.2 years as of mid-2017. Many units are still years away from completion.

- All reactors under construction in at least 10 of the 17 countries have experienced mostly year-long delays. At least 33 (64 percent) of all building projects are delayed.

- Of the 33 reactors clearly documented as behind schedule, at least 12 have reported increased delays and four have reported new delays over the past year.

- Thirteen reactors were scheduled for startup during 2019, but only six made it.

- Construction start of two projects dates back 35 years, Mochovce-3 and -4 in Slovakia, and their startup has been further delayed, currently to 2020–2021. Bushehr-2 originally started construction in 1976, that is 44 years ago, and resumed construction in 2019 after a 40-year-long suspension. Grid connection is currently scheduled for 2024.

- Five reactors have been listed as “under construction” for a decade or more: the Prototype Fast Breeder Reactor (PFBR) in India, Olkiluoto-3 (OL3) in Finland, Shimane-3 in Japan, the Flamanville-3 (FL3) in France, and Leningrad 2-2 in Russia. The Finnish project has been further delayed this year, grid connections of the French and Indian units are likely to be postponed again, and the Japanese reactor does not even have a provisional startup date.

- Nine countries completed 63 reactors—with 37 in China— over the past decade, with an average construction time (start to grid connection) of 10 years.

Construction Starts & New-Build Issues

Construction Starts. In 2019, construction began on six reactors—four in China and one each in Russia and the U.K.—and in the first half of 2020 on one (in Turkey). These were the first construction starts of commercial reactors in China since December 2016. This compares to 15 construction starts in 2010 and 10 in 2013. Construction starts peaked in 1976 at 44.

Over the decade 2010–2019, construction began on 67 reactors in the world. As of mid-2020, only 18 have started up, while 44 remain under construction (5 cancelled).

Construction Cancellations. Between 1970 and mid-2020, a total of 93— one less than in WNISR2019 as Bushehr-2 restarted construction in 2019—that is one in eight of a total of 773 constructions were abandoned or suspended in 19 countries at various stages of advancement.

Nuclear Power in the Age of COVID-19

COVID-19 is the first pandemic of this scale in the history of nuclear power. Nuclear utilities have been fast to point to the “crucial” role nuclear power played during the pandemic as a source of electricity. But the picture is more complex, with various safety and security routines becoming more difficult or impossible during a pandemic:

- Periodic and frequent testing is usually done at systems to provide assurance that vitally important functions like the emergency control room operations, emergency electricity supply or emergency core cooling are in good working order.

- Normally periodic testing and inspections are performed under the four-eyes principle (at least two people have to be always present), which becomes challenging if social distancing is followed.

- Particular staff groups, like control-room personnel, with specific knowledge and qualification for specific facilities cannot easily be replaced.

- Emergency situations like a fire or toxic gas buildup in the control-room could easily be exacerbated by the need of social distancing; the challenge is even greater in the emergency control-room.

- Infections amongst security staff, a limited number of highly trained forces for specific facilities, could rapidly lower the protection level.

Infections, and Operator Response Strategies. Systematic national reporting on infections amongst nuclear staff did not happen anywhere, with the remarkable exception of Russia’s Rosatom, whose Director General made weekly video presentations on the evolution of active cases and recovered persons.

- Russian Rosatom graphic illustrations indicate a total of about 4,500 infections in the group, with 1,200 still recovering as of the end of July 2020.

- Only a handful of infections have been reported from nuclear facilities in Japan and South Korea.

- French utility EDF in mid-June 2020 indicated around 600 cases amongst the nuclear staff over a 12-week period, reaching around 2 percent at the peak of the pandemic.

- The Swedish regulator reported “few cases” but did not give numbers.

- At the U.K. Sellafield site about 1,000 employees self-isolated and the reprocessing plant was shut down. At least one EDF Energy employee died of COVID-19 at the Hinkley Point C construction site but no numbers have been published about tested/infected staff.

- In the U.S., several nuclear power plant sites have reported up to dozens of infected staff (e.g. Limerick, Waterford). At the Millstone reactor, three operators were amongst those that tested positive. An outage at Fermi-2 may have led to 200-300 infections. Operator DTE Energy refused to disclose exact numbers.

While numerous fuel-chain and research facilities were shut down, no country reported an enforced shutdown of a nuclear power plant. Various measures were taken, including:

- Operators dramatically reduced staff levels in nuclear plants, e.g. in France, 15,000 employees (two thirds) of EDF’s Nuclear Generation Division were put on telework. Reduced staff levels led to a lack of oversight of subcontractors.12

- Regulators granted operators permission to impose strikingly long work hours. For example, in the U.S., workers could work for up to 16 work hours in any 24-hour period and up to 86 work hours in any 7-day period or 12-hour shifts for up to 14 consecutive days.

- In some cases, e.g. in Russia and Sweden, control-room staff and essential personnel were isolated, and/or onsite housing was provided for workers during outages (also in the U.S.).

- Social distancing and remote working practices have been employed widely, but implementation seems to have varied in degrees of speed and rigor. In some cases, trade unions have reported practices very different from operator declarations, complaining about lack of masks and insufficient social distancing. In France, workers walked off at least three reactor sites considering their health and safety were not appropriately protected.

- Force-on-force exercises in the U.S. as well as many other security and safety training-sessions in several countries have been suspended during the pandemic, leading to a degraded readiness level.

- In many cases, refueling and maintenance outages have been altered to eliminate “non-critical work” or were deferred entirely to the end of the year or even into 2021. In some cases, like at Germany’s Grohnde and Spain’s Trillo-1, outages have been stretched out to allow for a lower density of workers.

- In some cases, e.g. at Canada’s Darlington-3 or Romania’s Cernavoda-1, planned major overhaul has been rescheduled. In France, the installation of emergency diesel generators at five reactors was delayed for a second time, to February 2021, two years after the first delay was granted.

- The pace of construction in at least 12 of the current 17 countries building nuclear reactors has been impacted, but apparently only in Argentina construction activities were entirely halted (on CAREM-25). A large outbreak took place at the Vogtle plant in Georgia, the only nuclear construction site in the U.S., where over 800 staff tested positive, with over 100 still affected as of late August 2020. As of late May 2020, about 100 cases were reported at the Belarus Ostrovets site.

Infections, and Regulator Response Strategies. Very little information has been made public about infections at national safety authorities and their Technical Support Organizations (TSOs). Some examples of infection levels and measures include:

- French regulator ASN claims that as of early August 2020 not a single staff person had tested positive. In late April 2020, the French TSO IRSN said 59 were “contaminated or likely to be”, all of whom recovered, but strangely another IRSN spokesperson said in early September 2020 that only nine people were actually tested positive and only 13 total of 1,800 staff were tested at all.13 Apparently, neither ASN nor IRSN have systematic testing programs in place.

- Safety authorities and their TSOs in several countries (e.g. Canada, Finland, France, U.S.) decided to halt site visits (except in cases of emergency). ASN carried out about 6 percent of the number of inspections it carries out on average under normal circumstances. IRSN also entirely suspended environmental sampling.

- Regulators generally have been very “pragmatic” and “flexible” in their decision-making and approved most operator requests for exemptions, exceptions and deferrals.

Degradation of Safety and Security. Nuclear officials in international organizations, industry groups, utilities and regulatory authorities have claimed in one way or another that all these measures were taken “while maintaining the required level of safety”, as ASN put it. The U.K. Office for Nuclear Regulation (ONR) found “no significant change to dutyholders’ safety and security resilience”.

This confidence is difficult to comprehend because working conditions have clearly deteriorated in many nuclear facilities, because scheduled repair and upgrading work was often not carried out or delayed for many months, and operators of many nuclear power plants in the world were left without any physical regulatory oversight as inspectors stayed home. So not only valves, joints, pipes and weldings were not checked by the operators as planned, but no physical inspection actually made sure that operators were doing what they said they were doing. Considering the long list of fraud cases in the industry (for a selection see Introduction to Nuclear Power in the Age of COVID-19), fully operational independent regulators and their TSOs remain a crucial ingredient to nuclear safety and security.

Even if the pandemic were to slow down—there is of course no guarantee that no second wave hits nuclear countries—the situation will take time to significantly improve. Operators and regulators will be struggling to get back to operational modes that are closer to normality, leave alone catching up on all of the delayed activities, which will likely take several years.

In addition, bulk prices plunged as operational costs went up, bulk prices dropped and electricity consumption plunged. The financial viability of some of these utilities may be at stake. Indispensable cost cutting exercises will further exacerbate the pressure.

This is far from over.

On the occasion of the first nuclear power plant entering the operational phase in an Arab country, i.e. Barakah in the United Arab Emirates (UAE), WNISR provides an overview of the nuclear energy ambitions of six countries in the Middle East: Iran, UAE, Turkey, Egypt, Saudi Arabia and Jordan (ordered by level of program advancement).

The region mainly depends on natural gas for electricity generation with five of the six assessed countries generating more than half of their power from gas; of these, three countries (Egypt, Jordan, UAE) rely on gas for more than 75 percent of the electricity.

Iran has one reactor in operation and another one under construction as well as various activities along the nuclear fuel chain. UAE has started up one unit in early August 2020, while three more reactors remain under construction. Turkey has two units under construction. As for Egypt, Saudi Arabia and Jordan, nuclear plans are more or less advanced, but no construction has yet begun. Egypt, Jordan and Turkey are struggling with high debt loads and unfavorable credit-ratings (highly speculative or “junk”). This makes capital-intensive investments like nuclear power particularly challenging, unless financing assistance from vendor countries is provided. While Egypt and Turkey have benefited from Russian financial assistance, Jordan is yet to obtain any financial aid.

Iran

- Construction had been disturbed by decades-long suspensions. Even after construction of Bushehr-1 had restarted in 1996, the project was plagued by delays and connected to the grid only in 2011, 35 years after construction first started, 15 years after construction restart.

- Production remains modest and in 2019, Bushehr-1 represented less than 2 percent of electricity generation in the country.

- According to official estimates, Iran’s solar capacity potential is a stunning 40 TW (40,000 GW).

United Arab Emirates

- Construction of the Barakah plant by the Korean Electric Power Corp. (KEPCO) is about three years behind schedule. Barakah-1 was planned to start up in 201714, with Units 2, 3 and 4 following each other with one-year distance. Amongst the reasons for delays were construction problems (cracks/voids in the containment) and difficulties in establishing a local, trained operator workforce.

- Cost comparisons between the nuclear and solar options show:

- The official cost estimate of Barakah power of US$72/MWh in 2012 was below the lowest level of Lazard’s international cost range for the year of US$78–114;

- A Power Purchasing Agreement (PPA) for a 1.2 GW solar photovoltaic capacity signed in 2017 at US$24.2/MWh; the plant was connected to the grid in 2019.

- Earlier in 2020, a solar power bid was made by EDF/Jinko for 1.5 GW at US$13.5/MWh, five times lower than the no doubt underestimated original cost of Barakah power and 9–14 times below Lazard’s nuclear cost estimate for 2019 of US$118–192/MWh.

Turkey

- Construction at Akkuyu-1 was launched by Russian builder Rosatom in April 2018 followed by Akkuyu-2 in April 2020. Startup for the first unit was planned for 2023, which is unlikely to happen. The Akkuyu project has been in the planning since the 1970s and was delayed countless times. The construction itself was hampered with technical problems including cracks identified in the basemat that had to be repaired. Nuclear power has met with fierce opposition, nationally and locally, concerned about nuclear safety, earthquake risks and negative social impacts. Two thirds of Turkish people polled opposed nuclear power in a 2018 survey.

- Cost comparisons between the nuclear and solar options show that in 2018 solar PPAs came in at US$65/MWh, almost half the cost for nuclear electricity estimated in 2012.

Jordan

- Project Planning. Eleven years after the first feasibility study for nuclear energy, in 2018, Jordan pulled the plug on any project for large nuclear power plants and focused planning on Small Modular Reactors (SMRs). After signing cooperation agreements with potential vendors from China, Russia, U.K. and the U.S. no further progress has been made.

- Cost comparisons between the nuclear and solar options show a 2012-nuclear-cost estimate at around US$100, compared to a 2017-PPA for 50 MW solar at US$59/MWh connected to the grid in late 2019, and a bid at US$25/MWh in 2018. The country set a 20-percent target from renewable sources in the power mix for 2025.

Egypt

- Project Planning. The Egyptian Atomic Energy Commission was established in the mid-1950s and the idea of building nuclear power plants was explored as early as the mid-1970s. But it took until 2016 to sign a loan agreement with Russia for the construction of four Rosatom reactors. In March 2019, a site permit was issued for Dabaa on the Mediterranean coast. Construction is planned to begin in 2020.

- Cost comparisons show a 2015-estimate for nuclear power at US$110/MWh vs. a 2019-PPA for solar power at US$24.8/MWh, four times cheaper. In 2016, the Government set a 37-percent-share target for renewables in the electricity mix by 2035 vs. 3 percent for nuclear energy.

Saudi Arabia

- Project Planning. In 2018, the Government approved a nuclear program of two reactors to be built in the 2020s, and possibly more later. However, no vendor has been chosen and no site selected. The Government has also been interested in the development of domestic uranium mining and enrichment for fuel. The country has also shown interest in the development of SMR technology, without much tangible progress so far.

- Cost comparisons between the nuclear and renewable energy options are not possible because there are no cost estimates for nuclear power. However, a PPA for solar power at US$16/MWh, signed in 2016, underlines the competitiveness of photovoltaic electricity in the region.

The following seven Focus Countries covered in depth in this report represent almost one fourth of the nuclear countries hosting about two-thirds of the global reactor fleet. Key facts for year 2019:

China. Nuclear power generation grew by 19.2 percent in 2019 and contributed 4.9 percent of all electricity generated in China, up from 4.2 percent in 2018. Plans for future expansion remain uncertain.

Finland. Nuclear generation reached a new record in 2019. The Olkiluoto-3 EPR project was delayed yet again, and, according to an announcement from April 2020, “regular production of electricity” will not happen before February 2022; that constitutes nearly two years of additional delay since the previous announcement only one year earlier, and 13 years after the original planned startup date.15

France. Nuclear plants generated 3.5 percent less power than in 2018, representing 70.6 percent of the country’s electricity, the lowest share in 30 years. Outages at zero capacity cumulated 5,580 reactor-days or more than three months per reactor on average. All outages at 54 of the 58 units were extended beyond the planned duration, leading to an average 44-percent increase of the outage time. A damning report by the Court of Accounts slams the lack of government oversight of the Flamanville-3 EPR construction project that is at least 10 years behind schedule and recalculated the cost at over €201519 billion (US$202020 billion) including financing.

Japan. Nuclear plants generated more power than in any year since Fukushima disaster began in 2011 and provided 7.5 percent of the electricity in 2019. As of mid-2020, nine reactors had restarted but that number has not increased since mid-2018. Four units were taken off the grid again in mid-2020 for various reasons, and power output is expected to drop by up to half in 2020. A large bribery scandal involving KEPCO management including the president rattled the industry.

South Korea. Nuclear power output recovered by 9 percent after a decline of 19 percent since 2015 and supplied 26.2 percent of the country’s electricity. If adopted, a draft energy bill under review would further reduce nuclear’s role to providing just 10 percent of power by 2034.

United Kingdom. Nuclear generation decreased again and provided only 14 percent of the power in the country, down from 17.7 percent in 2018. The fleet’s aging units, over 36 years on average, are struggling with many technical issues, in particular irreparable damage to moderator graphite bricks leading to lengthy outages of the Advanced Gas-cooled Reactors (AGRs). Three units newly qualified for the LTO category. While construction officially started at Hinkley Point C-2, prospects for other new-build projects remain uncertain.

United States. Nuclear power plants generated a new historic maximum of 809 TWh (+1.4 TWh), while their share in the electricity mix remained below 20 percent (19.7 percent). The continuous excellent productivity of the ageing U.S. fleet, average age 40 years, is intriguing and contrary to the performance of other early programs. The NRC issued its first license extension to 80 years. But nuclear units have increasing difficulties to economically compete in the market. State subsidies have been granted to four uneconomic nuclear plants to avoid their “early closure”. Following the revelation of an unprecedented corruption scheme in Ohio, involving the State’s Speaker of the House, two of these “bailouts” might be reversed. Many other units remain threatened with early closure for economic reasons. A series of other criminal affairs involving the nuclear industry were revealed over the past two months.16

Following assessments of the development status and prospects of Small Modular Reactors (SMRs) in WNISR2015 and WNISR2017, this year’s update does not reveal great changes.

Argentina. The CAREM-25 project under construction since 2014 is reportedly 55 percent complete. A significant construction interrupted work in November 2019 complaining about late payments and design changes. COVID-19 led to a complete construction stop.

Canada. Three provincial Governments have embraced the idea to promote SMRs for remote communities and mining operations. Various models are being investigated. The environmental impact assessment process for the proposed first demonstration high temperature reactor is underway.

China. A high-temperature reactor under development since the 1970s has been under construction since 2012. Startup has been delayed several times and is now planned for 2021, four years later than scheduled.

India. An Advanced Heavy Water Reactor (AHWR) design has been under development since the 1990s, and its construction start is getting continuously delayed. No major news since WNISR2019.

Russia. Two “floating reactors” were finally connected to the grid in December 2019. As construction started in 2007, it took about four times as long as planned. The costs were estimated at US$2015740 million in 2015 (likely underestimated) or US$11,600 per installed kilowatt, significantly more expensive than the most expensive Generation III reactors.

South Korea. The System-Integrated Modular Advanced Reactor (SMART) has been under development since 1997. In 2012, the design received approval by the safety authority, but nobody wants to build it in the country, because it is not cost-competitive.

United Kingdom. Rolls-Royce is the only company interested in participating in the Government’s SMR competition but has requested significant subsidies, including for investing in a factory. The Rolls-Royce pre-design is at a very early stage but, at 440 MW, it is not really small. As of 1 September 2020, the design was not even under examination by the regulator.

United States. The Department of Energy (DOE) has generously funded companies promoting SMR development. A single design by NuScale is in the final stage of the design certification process.17 However, the Nuclear Regulatory Commission and the Advisory Committee on Reactor Safeguards identified some significant safety problems that will have to be resolved in the future.

Overall, there are few signs that would hint at a major breakthrough for SMRs, either with regard to the technology or with regard to the commercial side.

Over nine years have passed since the Fukushima Daiichi nuclear power plant accident (Fukushima accident) began, triggered by the East Japan Great Earthquake on 11 March 2011 (referred to as 3/11 throughout the report) and subsequent events. The onsite situation is still not stabilized and numerous offsite challenges remain.

Spent Fuel Removal from the pool of Unit 3 started in April 2019. Only about one fifth had been removed one year on. Units 1 and 2 have not gotten beyond the preparatory stage.

Fuel Debris Removal is now planned to start with Unit 2 by 2021. Further delays are likely.

Contaminated Water Management. Water injection continues to cool the fuel debris of Units 1–3. Highly contaminated water runs out of the cracked containments into the basements where it mixes with water that has penetrated the basements from an underground river. The commissioning of a dedicated bypass system and the pumping of groundwater has reduced the influx of water from around 400 m3/day to about 170 m3/day. However, in FY2019, pumped contaminated water increased again to 180 m3/day. An equivalent amount of water is partially decontaminated and stored in 1,000-m3 tanks. Thus, a new tank is needed every 5.5 days. The storage capacity onsite of 1.4 million m3 is expected to be saturated by the end of 2022. Plans to release the contaminated water into the ocean are widely contested, including overseas.

Worker Health. As of March 2020, there were 7,000 workers involved in decommissioning work on-site, 87 percent of whom were subcontractors; only the remaining 13 percent worked for Tokyo Electric Power Company (TEPCO). Maximum effective dose levels accepted for subcontractors turned out eight times higher than for TEPCO employees.

Amongst the main offsite issues are the future of tens of thousands of evacuees, the assessment of health consequences of the disaster, the management of decontamination wastes and the costs involved.

Legal Issues. In September 2019, the Tokyo District Court acquitted three former TEPCO top managers accused of professional negligence resulting in injury or death. The ruling was widely condemned as flawed, and the lawyers for the plaintiffs have filed an appeal to the Tokyo High Court.

Evacuees. As of April 2020, almost 39,000 Fukushima Prefecture residents—not including “self-evacuees”—were still officially designated evacuees. According to the Prefecture, the number peaked just under 165,000 in May 2012. The Government intends to continue the lifting of restriction orders for affected municipalities. However, according to a recent survey, only 1.8 percent of the people returned to Okuma Town and 7.5 percent to Tomioka Town.

Health Issues. Officially, as of February 2020, a total of 237 people had been diagnosed with a malignant tumor or suspected of having a malignant thyroid tumor and 187 people underwent surgery. While the cause-effect relationship between Fukushima-related radiation exposure and illnesses has not been officially established, questions have been raised about the examination procedure itself and the processing of information. However, a 2019-study concludes that “the average radiation dose-rates in the 59 municipalities of the Fukushima prefecture in June 2011 and the corresponding thyroid cancer detection rates in the period October 2011 to March 2016 show statistically significant relationships”.

Food Contamination. According to official statistics, among over 266,000 samples taken in FY 2020, a total of only 157 food items were identified as being contaminated beyond legal limits. As of March 2020, post-3/11 import restrictions remain in place in 20 countries (three less than a year earlier).

Decontamination. The contaminated soil in the temporary storage area in Fukushima Prefecture is currently being transferred to intermediate storage facilities in eight areas. As of June 2020, around 56 percent of the total amount of 14 million m3 had been shipped. The soil is to be processed through various stages of volume reduction before being shipped to a final repository.

Decommissioning Status Report – Soaring Costs

As more and more nuclear facilities either reach the end of their pre-determined operational lifetime or close due to deteriorating economic conditions, their decommissioning is becoming a key challenge.

- As of mid-2020, 189 reactors were closed, eight more than a year earlier, of which 169 are awaiting or are in various stages of decommissioning.

- Only 20 units have been technically fully decommissioned, one more than a year earlier: 14 in the U.S., five in Germany, and one in Japan. Of these, only 10 have been returned to greenfield sites.

- The average duration of the decommissioning process is about 20 years, with a large range from 6–42 years.

- Progress in decommissioning projects around the world remains slow. In France, the two Fessenheim reactors entered the warm-up stage and Superphénix entered the hot-zone stage. In Germany four reactors advanced to the hot-zone stage, while one additional reactor entered the warm-up-stage. In the U.S., two more reactors entered the warm-up stage, while one plant finished the technical decommissioning process.

- Although they were early to start nuclear power programs, Canada, France, Russia and U.K. have not fully decommissioned even one reactor so far.

Nuclear Power vs. Renewable Energy Deployment

Renewable energy deployment and generation has better resisted the impacts of the COVID-19 pandemic than the nuclear power sector. In the first quarter of 2020, renewables increased output by an estimated 3 percent and its relative share in global generation rose by 1.5 percentage points, while nuclear output fell by about 3 percent.

Costs. Levelized Cost of Energy (LCOE) analysis shows that between 2009 and 2019, utility-scale solar costs came down 89 percent and wind 70 percent, while new nuclear costs increased by 26 percent. The gap has continued to widen between 2018 and 2019.

Investment. In 2019, for the third time after 2015 and 2017, the total investment in renewable electricity exceeded US$300 billion, almost ten times the reported global investment decisions for the construction of nuclear power of around US$31 billion for 5.8 GW. Investment in nuclear power is less than a quarter of the investment in wind (US$138 billion) and solar (US$131 billion) individually. China remains the top investor in renewables, spending US$83 billion in 2019, down 9 percent compared to 2018.

Installed Capacity. In 2019, a new record 184 GW (+20 GW) of non-hydro renewables were added to the world’s power grids. Wind added 59.2 GW and solar-photovoltaics (PV) 98 GW, both slightly below the 2017-levels. These numbers compare to a net 2.4 GW increase for nuclear power.

Electricity Generation. In 2019, annual growth for global electricity generation from solar was 24 percent, for wind power about 13 percent and 3.7 percent for nuclear power, half of which is due to China.

Low-Carbon Power. Compared to 1997, when the Kyoto Protocol on climate change was signed, in 2019 an additional 1,418 TWh of wind power was produced globally and 723 TWh of solar PV electricity, compared to nuclear’s additional 394 TWh. Over the past decade, non-hydro renewables have added more kilowatt-hours than coal or gas, twice as many as hydropower, and 22 times as many as nuclear plants.

Share in Power Mix. After experiencing the strongest annual growth on record, the share in power generation from new renewables (excluding hydro) reached 10.39 percent, surpassing nuclear energy’s share (10.35 percent) for the first time.

In China, electricity production of 406 TWh from wind alone again by far exceeded the 330 TWh from nuclear, while solar power is already at 224 TWh.

In India, generation from wind power (63 TWh) outpaced nuclear again, but for the first time, generation from solar energy (46 TWh) exceeded the nuclear output of 41 TWh.

In the European Union, solar installed capacity for the first time exceeded the nuclear one in the EU28 with 130 GW vs. 116 GW. Wind had outpaced nuclear already in 2014 and has since enlarged the gap. Renewables (incl. hydro) generated a record 35 percent of electricity, while nuclear provided 25.5 percent. Hard coal generated electricity declined by an unprecedented 32 percent and lignite power by 16 percent, while natural gas increased by 12 percent. Wind power output grew by 14 percent and solar by 7 percent, while nuclear declined by 1 percent.

In the United States, electricity generation from coal plunged to a 42-year low, and in April 2019, for the first time since 1885, the renewable energy sector (hydro, biomass, wind, solar and geothermal) generated more electricity than coal-fired plants. While nuclear energy’s share stayed stable, it is set to decline. With three reactors closed in 2019 and the first half of 2020, and more closures expected, the nuclear capacity is shrinking. In 2019, for the first time, installed wind power exceeded installed nuclear capacity with 104 GW vs. 98 GW. Over the past decade, wind + solar have quadrupled combined electricity generation while nuclear production has not moved.

Since the release of the previous edition of the World Nuclear Industry Status Report (WNISR) in September 2019, the world has changed dramatically and is undergoing the worst global pandemic and the most devastating global economic crisis in a century. This is in addition to the increasingly acute climate change emergency. And much has been said about the systemic interdependencies between these crises, which is not the subject of this report.

It was an obvious choice for the WNISR-Team to elaborate a focus chapter providing a preliminary international assessment on the impact of the COVID-19 pandemic on the nuclear sector and the reactions of operators and regulators (see Nuclear Power in the Age of COVID-19). The most striking outcome of the analysis is the display of confidence by the main stakeholders that “everything is fine”. While most outages for maintenance and repairs were delayed, many nuclear facilities operated with a fraction of normal staffing levels, and virtually all physical inspections by safety authorities were cancelled for at least two months. Some of the large nuclear operators like the French EDF or the Russian Rosatom were hit with hundreds of COVID-19 cases. No information is publicly available about the impact on specific areas of work. How can regulators assure parliamentarians, citizens and Governments that the operators were “maintaining the required level of safety”, as the French chief regulator put it18 if they have not been on the sites for weeks?

The in-depth assessment of the safety and security implications of the COVID-19 crisis—not only in the past months, but also in the coming years, as outage schedules will be impacted over the coming at least two years—would go far beyond the scope of this report. But there is a major public interest in getting this analysis done, soon.

The second focus chapter of WNISR2020 is devoted to Nuclear Power in the Middle East. With the first nuclear power reactor starting up in the Arab world, at the Barakah site in the United Arab Emirates (UAE), it was an appropriate time to analyze the energy policies in the region and the role of nuclear power. The deployment of nuclear energy projects in a region that has a high security volatility raises additional questions such as the comparative vulnerability of energy infrastructure that are outside the scope of this report. The recent threat by the Azerbaijani Government to bomb the Armenian nuclear plant was a reminder of the security implications of an existing nuclear facility in cases of international conflict or terrorism. “The Armenian side mustn’t forget”, Azerbaijani Defense Ministry spokesman Vagif Dargyakhly said in a 16 July 2020 statement, “that the most advanced missile systems our army has are capable of launching a precision strike on the Metsamor nuclear power plant, and that would be a huge tragedy for Armenia”.19 Only two days earlier, Al Jazeera posted a video on twitter20 that raised the possibility of attacks on the Barakah nuclear plant. Three weeks later, the first reactor of the four-unit Barakah complex was connected to the grid.

The WNISR deadline for statistical and major editorial information is 1 July. This year, July and August were particularly rich in nuclear and energy related information. Here are some news items likely to be analyzed in more detail in the WNISR2021, some of which reflect a surprising level of corruption and other illegal activities in the nuclear sector:

- The U.S. International Development Finance Corporation (DFC) lifted its long-standing ban on funding of nuclear energy projects overseas.21 This makes the DFC one of the few development banks that allow investment in new nuclear projects. The World Bank and the Asian Development Bank (ADB) amongst others do not permit funding of new nuclear power projects.

- The speaker of the Ohio House of Representatives, Larry Householder, was arrested by the U.S. Federal Bureau of Investigation (FBI) on charges of racketeering. Allegedly, he and his associates had set up a US$60 million slush fund “to elect their candidates, with the money coming from one of the state’s largest electricity companies. (…) Prosecutors contend that in return for the cash, Mr. Householder, a Republican, pushed through a huge bailout of two nuclear plants and several coal plants that were losing money.”22 As a consequence, in 2019, FirstEnergy’s Oak Harbor and Perry reactors were granted generous US$1.3 billion of taxpayer-money support to keep their uneconomic units on the grid. The conspiracy was “likely the largest bribery, money-laundering scheme ever perpetrated against the people of the state of Ohio,” the U.S. attorney for the Southern District of Ohio, David M. DeVillers, said in a news conference.23

- The revelation of the massive bribery affair in Ohio came within days of U.S. federal prosecutors in Chicago charging Commonwealth Edison (ComEd) with bribery and a US$200 million fine. ComEd, the largest electric utility in Illinois, paid at least US$1.3 million in contracts, jobs, and other payments to associates of state House Speaker Michael Madigan, a Democrat, and “in return received [US]$150 million in benefits resulting from legislation that relaxed oversight of the utility”.24

- In a different affair, Steve Byrne, former Vice-President of SCANA—the utility that in 2017 abandoned construction of the V.C. Summer plant in South Carolina—pleaded guilty to fraud charges in federal court. Peter McCoy, U.S. Attorney for South Carolina, told the Federal District Court in Columbia that Byrne “joined a conspiracy with other senior SCANA executives to defraud customers of money and property through... false and misleading statements and omissions.” The guilty plea was the result of a three-year investigation by the FBI and prosecutors at the Federal Attorney’s Office in Columbia. The fraud charges he pleaded to can carry up to five years in prison. The company had spent over US$9 billion, much of it ratepayer money, prior to folding the project.25

- In the aftermath of the ComEd scandal, the company’s owner Exelon, operator of the largest nuclear fleet in the U.S., was concerned its attempts to impose legislative change to allow for subsidies for its uneconomic Byron and Dresden plants in Illinois could fail. Exelon CEO Chris Krane stated: “If we can’t find... a path to profitability, we will have to shut them down.”26 Three weeks later Kane announced the early closure of the four reactors, the two 33- and 35-year-old units at Byron in September 2021 (although licensed for another 20 years) and the 49 and 50-year-old units at Dresden in November 2021 (licensed for another decade).27

- As a result of storm damage incurred on 10 August 2020, the Duane Arnold-1 reactor will not return to service and will instead be permanently closed. It was previously scheduled for closure on 30 October 2020. This is the second reactor closure in the U.S. and the fourth in the world since the beginning of 2020.28

- EDF Energy is to close its Hunterston B plant in the U.K. in late 2021, at least two years earlier than planned. Serious graphite cracking and other damage had been identified at the two 44- and 43-year-old Advanced Gas-cooled Reactors (AGRs) in 2018 and the units were shut down over the past two years. Repairs for longer-term operation turned out impossible or too costly.29.

- The startups of the Franco-German nuclear projects in Finland and France have been delayed for the nth time. While the first EPR started building in Olkiluoto in 2005 and was, at the time, scheduled to deliver power by 2009, “regular electricity generation” is now planned for February 202230 (see Finland Focus); the second one in Flamanville started construction in 2007 and was supposed to supply electricity by 2012 but power generation is now not expected before 2023. Popular Mechanics concluded: “France’s Revolutionary Nuclear Reactor Is a Leaky, Expensive Mess.”31

- The French Financial Market Authority (AMF) imposed a fine of €5 million (US$6 million) on EDF and a fine of €50,000 (US$60,000) on Henri Proglio, former CEO of EDF for “disseminating false information” on the Hinkley Point C project in the U.K. The AMF ruled that by claiming in a news release of 8 October 2014 that earlier agreements remained “unchanged”, when there had in fact been “significant changes to the financing plan by guaranteed debt, EDF had disseminated false information likely to set the share price at an abnormal or artificial level”.32

While the nuclear industry was struggling with COVID-19 cases, dramatically reduced workforces in operating plants and facilities under construction, the renewable energy industry apparently suffered much less and shorter impacts of the pandemic. It is obvious that operating solar plants or wind farms need significantly less maintenance by fewer workers than a nuclear facility. Also, the construction of new generating facilities requires less workers on-site at any given time in the renewable sector than in the case of nuclear. New renewables (excluding hydro) come in much smaller units, and therefore appear as a whole significantly more resilient than in the nuclear sector.

- The lowest ever commercial offer for solar electricity was issued in Portugal in August 2020 at €11.14/MWh (US$13.2/MWh), just below a July 2020 bid in Abu Dhabi at US$13.5/MWh (see Figure 25).33

- Wind and solar electricity generation increased by 19 percent year-on-year in the first seven months of 2020 across the Big-5 power markets (France, Germany, Italy, Spain, U.K.) with solar power generation at an all-time high34, while nuclear generation was on the decline in many nuclear countries around the world.

- China’s newly installed solar capacity has recovered quickly after a year-on-year decline due to COVID-19 in the first quarter of 2020, and the half-year result is even slightly above 2019 (11.5 GW vs. 11.4 GW).35

- In spite of COVID-19, wind power capacity additions in the first half of 2020 exceeded 2019-results significantly in major markets including the E.U., Japan and the U.S. where added capacity more than doubled to over 4 GW.36

- In spite of COVID-19, global investment in new renewables increased year-on-year in the first half of 2020 by 5 percent to an estimated US$132 billion, driven by the tripling of investments in off-shore wind to US$35 billion.37

And as a consequence of some of the development mentioned above:

- As of mid-2020, energy consumption in the U.S. fell to its lowest level in 30 years; 19 energy companies, mostly oil and gas, had filed for bankruptcy in the U.S. in these six months.38 (Already in April 2020, for the first time ever, oil was traded at negative prices and producers paid shippers to get rid of it).