The World Nuclear Industry Status Report 2012 (HTML)

Table of contents

Executive Summary & Conclusions

Introduction

General Overview Worldwide

Overview of Operation, Power Generation, Age Distribution

Overview of Current New Build

Potential Newcomer Countries

Projects and programs officially abandoned in 2011

Unfulfilled Promises

Unrealistic Projections

Construction Times of Past and Currently Operating Reactors

Construction Times and Costs of Reactors Currently Under Construction

Watts Bar-2 – 43 Years Construction

EPR – European Problem Reactor

Financial Markets and Nuclear Power

Financial Institutions’ Views of Nuclear Power

Credit Rating Agencies and Nuclear Power

Market Value

Book Value

Nuclear Power vs. Renewable Energy Deployment

Investment

Installed Capacity

Electricity Generation

The Renewables and Nuclear Cost Cross-Over

Grid Parity

Nuclear vs. Renewable Costs

Annexes

Annex 1: Overview by Region and Country

Africa

The Americas

United States Focus

Asia

China Focus

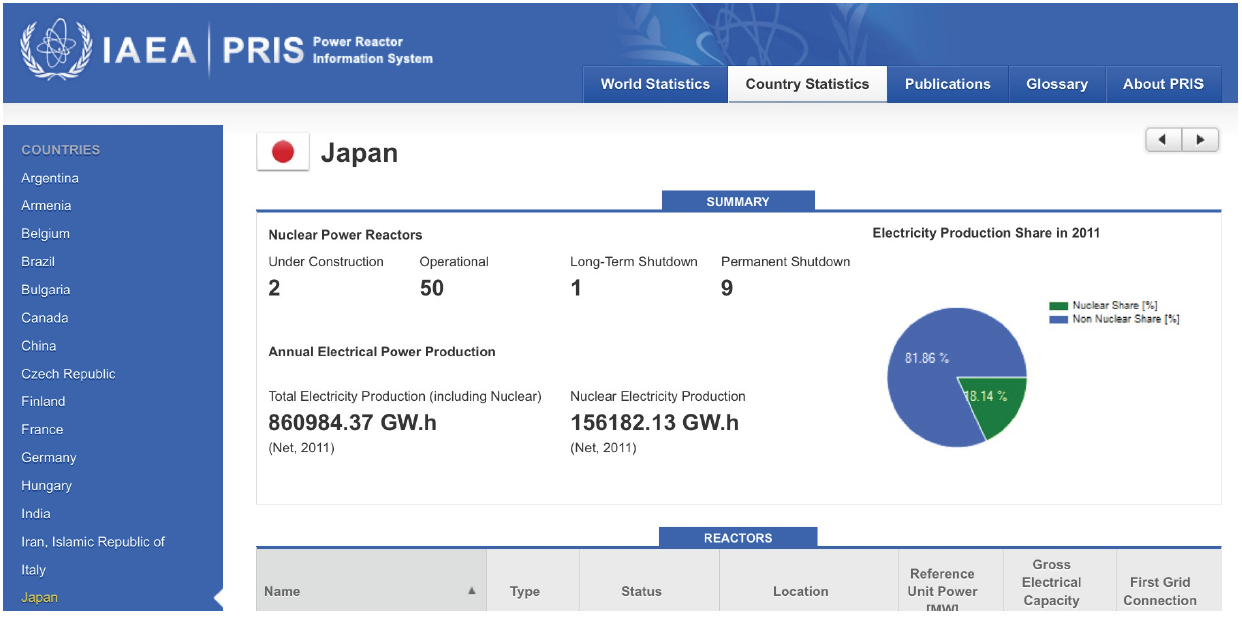

Japan Focus

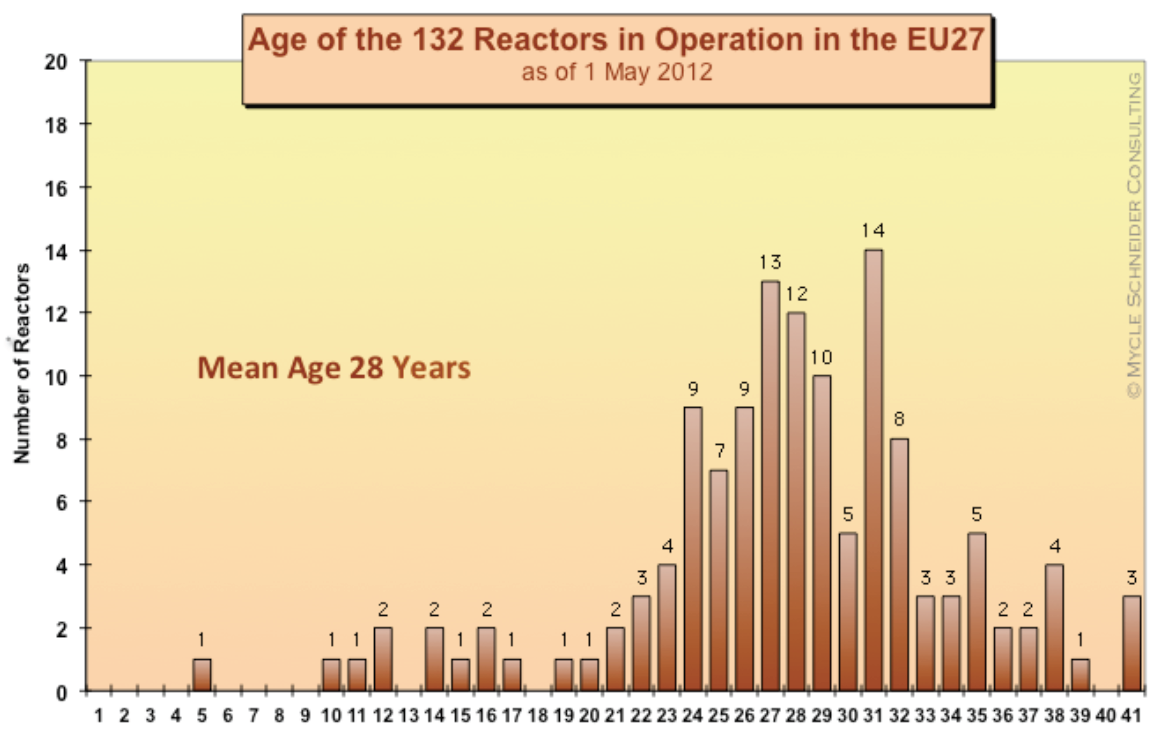

European Union (EU27) and Switzerland

Western Europe

France Focus

Germany Focus

U.K. Focus

Central and Eastern Europe

Former Soviet Union

Annex 2: Reactor Construction Times 1992-2012

Annex 3: Construction and Operating License (COL) Applications in the U.S.

Annex 4: Construction Times in the U.S. and France

Annex 5: Definition of Credit Rating by the Main Agencies

Annex 6: Abbreviations

Annex 7: Status of Nuclear Power in the World (1 July 2012)

Annex 8: Nuclear Reactors in the World Listed as “Under Construction” (1 July 2012)

Executive Summary & Conclusions↑

Twenty years after its first edition, World Nuclear Industry Status Report 2012 portrays an industry suffering from the cumulative impacts of the world economic crisis, the Fukushima disaster, ferocious competitors and its own planning and management difficulties.

The report provides a global overview of the history, the current status and trends of nuclear power programs in the world. It looks at units in operation and under construction. Annex 1 also provides detailed country-by-country information. A specific chapter assesses the situation in potential newcomer countries. For the first time, the report looks at the credit-rating performance of some of the major nuclear companies and utilities. A more detailed chapter on the development patterns of renewable energies versus nuclear power is also included.

The performance of the nuclear industry over the 18 months since the beginning of 2011 can be summed up as follows:

Reactor Status and Nuclear Programs

• Startups and Shutdowns. Only seven reactors started up, while 19 were shut down in 2011 [1] and to 1 July 2012, only two were started up, just compensating for two that were shut down so far this year. As of end of June 2012 no reactor was operating in Japan and while two units at Ohi have got restart permission, it remains highly uncertain, how many others will receive permission to restart operations.

• Nuclear Phase Out Decisions. Four countries announced that they will phase out nuclear power within a given timeframe: Belgium, Germany, Switzerland and Taiwan.

• Newcomer Program Cancellations. At least five countries have decided not to engage or re-engage in nuclear programs, although they had previously planned to do so: Egypt, Italy, Jordan, Kuwait, and Thailand.

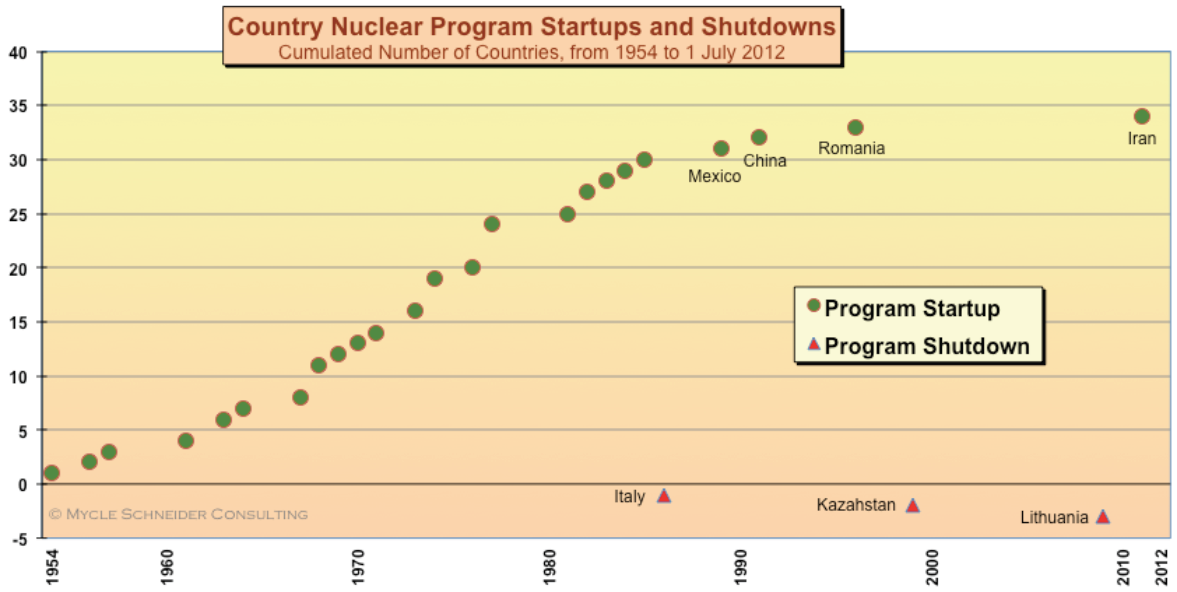

• New Nuclear Countries. Iran became the first country to start commercial operation of a new nuclear power program since Romania in 1996.

Construction & New Build Issues

• Construction Cancellation. In both Bulgaria and Japan two reactors under construction were abandoned.

• Construction Starts. In 2011, construction began on four reactors and two so far in 2012.

• New Build Project Cancellation. In Brazil, France, India and the United States new build projects were officially cancelled. In the Netherlands, the U.K. and the U.S. key utilities withdrew leaving projects in jeopardy.

• Certification Delays. The certification of new reactor technologies has been delayed numerous times. The latest announcement concerns the certification in the U.S. of the Franco-German designed EPR [2] that was pushed back by 18 months to the end of 2014.

• Construction Start Delays. In various countries firmly planned construction starts were delayed, most notably in China, where not a single new building site was opened, but also in Armenia, Finland and the U.S.

• Construction License Delays. In the U.S. licensing applications for 28 reactors were received for the first time in over three decades in a two-year period between July 2007 and June 2009, but nothing since. Of the 28 applications, 16 were subsequently delayed and eight were suspended indefinitely or officially cancelled. However, for the first time in over 30 years two construction licenses were issued.

• Construction Delays. Of the 59 units under construction in the world, at least 18 are experiencing multi-year delays, while the remaining 41 projects were started within the past five years or have not yet reached projected start-up dates, making it difficult to assess whether they are running on schedule. On construction delays the U.S. Watts-Bar-2 project holds the record. Construction started in 1973 and grid connection was finally planned for 2012, but was delayed again until “late 2015 or 2016”.

• Newcomer Countries. The analysis of a number of potential newcomer countries [3] shows that few, if any, new members of the nuclear operators club to be expected over the next few years. No financing agreements are in place for any of the cases studied, many of them have to deal with significant public opposition, especially after the Fukushima accident and often they lack a skilled workforce and appropriate legal framework. Some countries have to deal with particularly adverse natural conditions (earthquake and flooding risks, lack of cooling water access, etc.). Finally, nuclear power’s principle competitors, mainly renewables and natural gas on the production side, increasingly are more affordable and much faster to install.

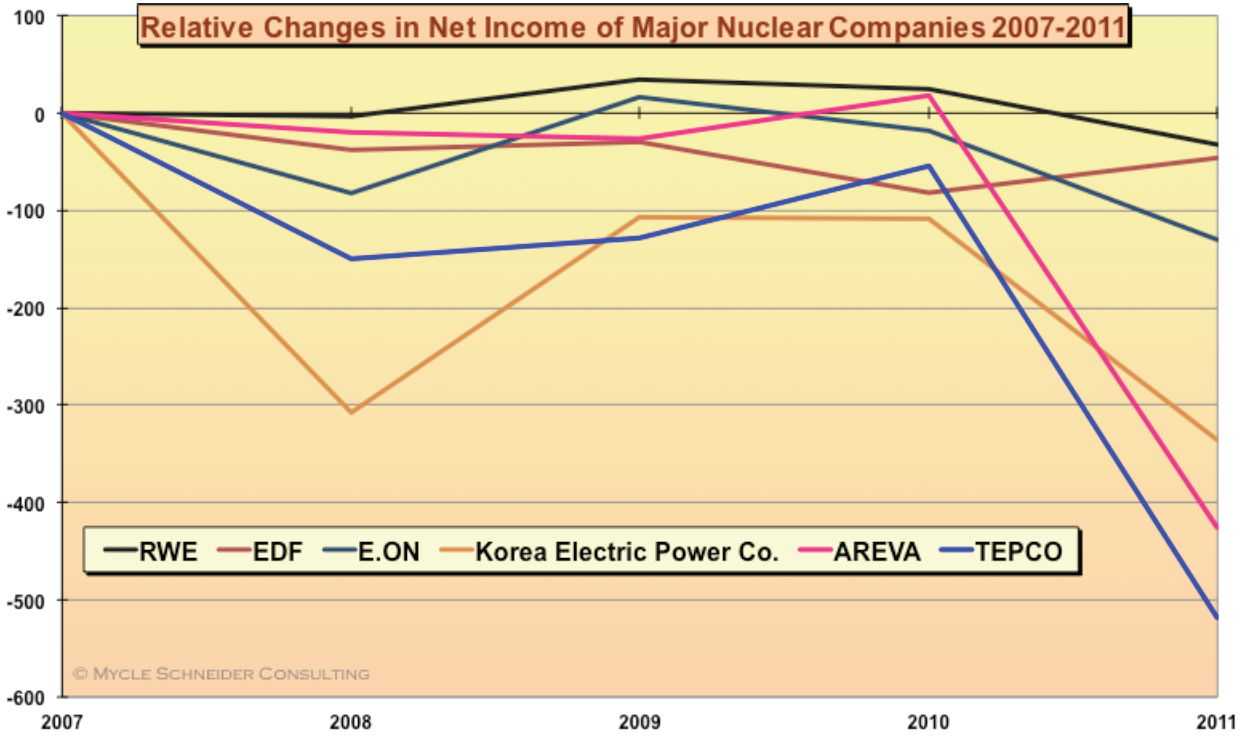

Economics & Finances

• Cost Increases. Construction costs are a key determinant of the final nuclear electricity generating costs and many projects are significantly over budget: The U.S. Watts-Bar-2 reactivation project alone increased by 60 percent over the past five years; the EPR cost estimate has increased by a factor of four (adjusted for inflation) over the past ten years.

• Credit Rating. Of eleven assessed nuclear companies and utilities, seven were downgraded by credit rating agency Standard and Poor’s over the past five years; four companies remained stable, while none were upgraded over the same period. Rating agencies consider nuclear investment risky and “a nuclear project could be the thing that pushes [the utility] over the edge—it’s just another negative factor”, explains Moody’s. On the contrary, the rating agency welcomed the decision by German utilities RWE and E.ON to pull the plug on their U.K. new build plans as they “can instead focus on investment in less risky projects”. Similarly, electronics giant Siemens announcement to entirely withdraw from nuclear power “frees up funds that Siemens can redeploy in businesses with better visibility”. Both decisions are consequently considered “credit positive”.

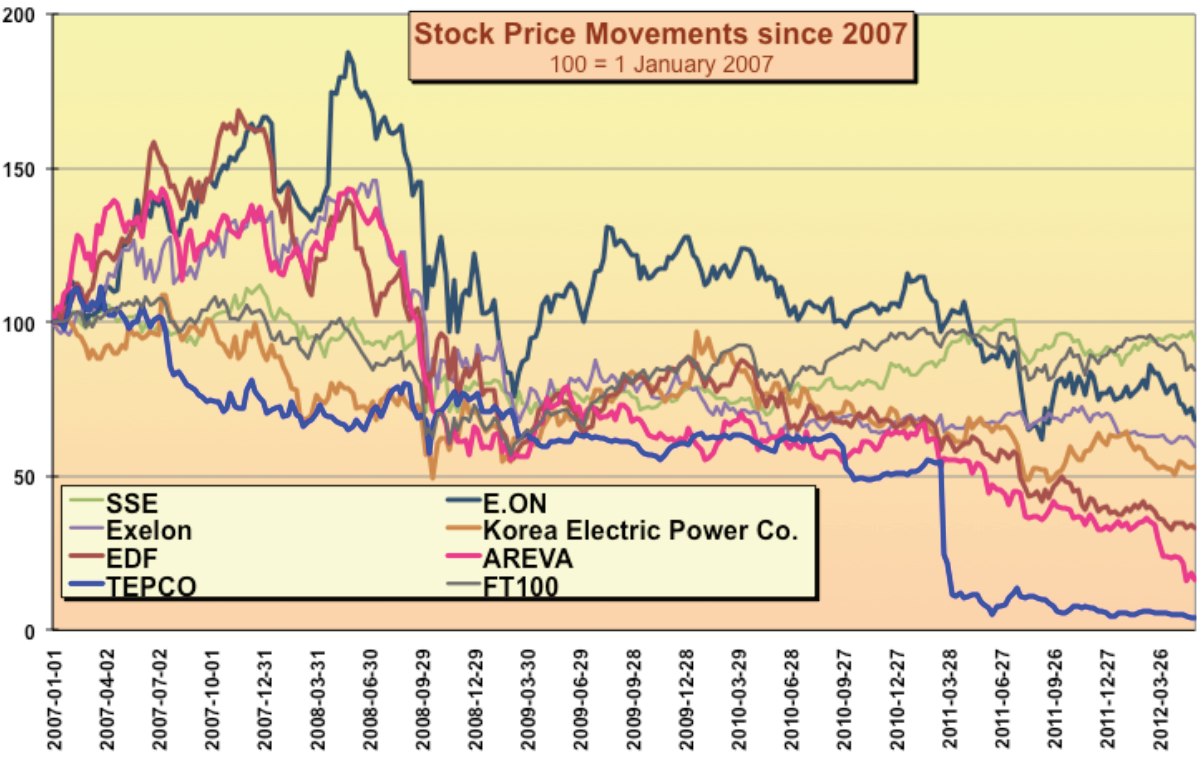

• Share Value. The assessment of a dozen nuclear companies reveals that all performed worse than the UK FTSE100 index, the only exception being Scottish SSE, which has recently pulled out of plans to build nuclear plants in the UK. TEPCO, owner of the devastated Fukushima site, lost 96% of its share value since 2007. Over the same time period, more surprisingly, the shares of the world’s largest nuclear operator, French state utility EDF, lost 82 percent of their value, while the share price of the world’s largest nuclear builder, French state company AREVA, fell by 88 percent.

Nuclear Power vs. Renewable Energy Deployment

In contrast to many negative indicators for nuclear power renewable energy development has continued with rapid growth figure. This has taken place during the ongoing international economic crisis, significant cuts in guaranteed feed-in tariffs and worldwide manufacturing overcapacities.

• Investment. Global investment in renewable energy totaled US$260 billion in 2011, up five percent from the previous year and almost five times the 2004 amount. Considering a 50 percent unit price drop over the past year, the performance of solar photovoltaics (PV) with US$137 billion worth of new installations, an increase of 36 percent, is all the more impressive. The total cumulative investment in renewables has risen to over US$1 trillion since 2004, according to Bloomberg New Energy Finance, this compares to our estimate of nuclear power investment decisions of approximately $120 billion over the same time period. The rise and fall of nuclear investments is essentially due to the evolution of the Chinese program, with 40 percent of current worldwide construction.

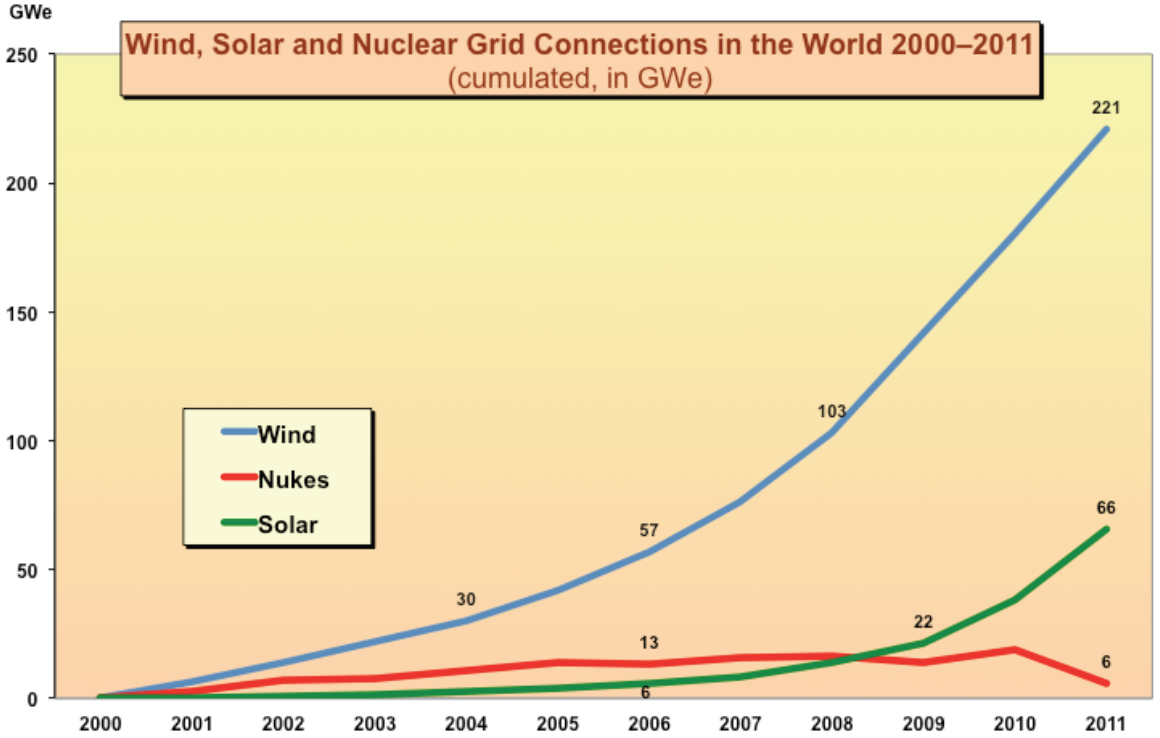

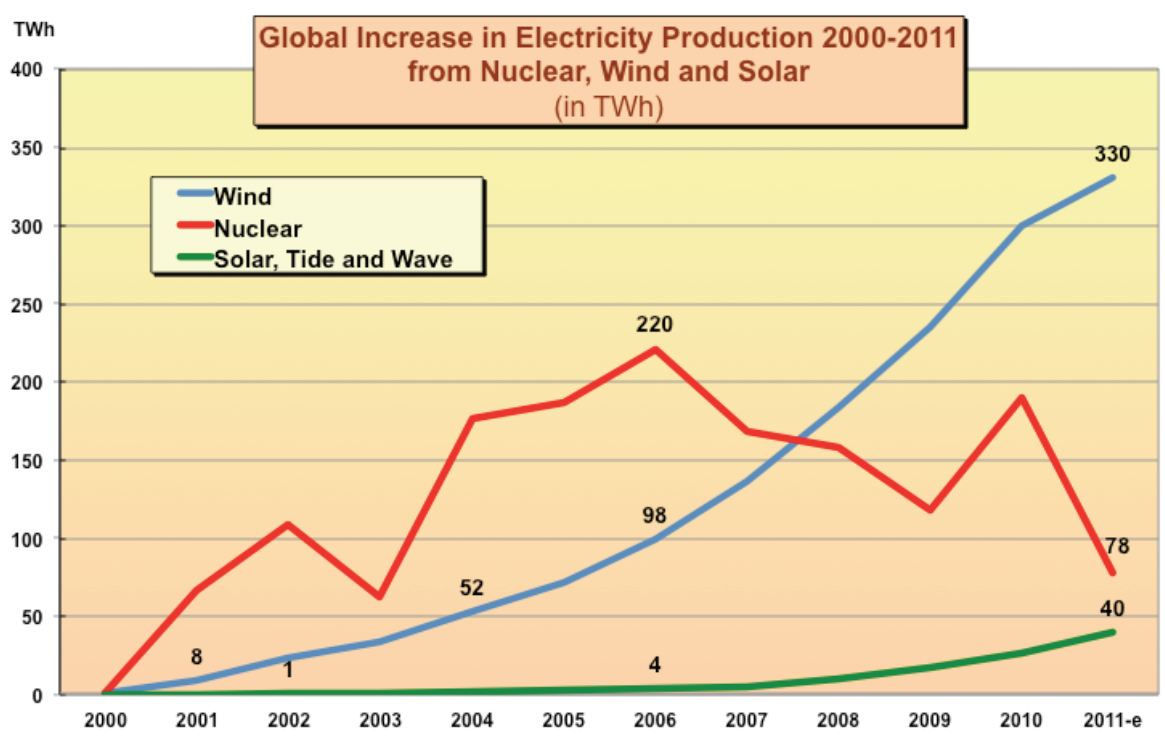

• Installed Capacity. Installed worldwide nuclear capacity decreased in the years 1998, 2006, 2009 and again in 2011, while the annual installed wind power capacity increased by 41 GW [4] in 2011 alone. China constitutes an accelerated version of this global pattern. Installed wind power capacity grew by a factor of 50 in the past five years to reach close to 63 GW, five times more than the installed nuclear capacity and equivalent to the French nuclear fleet. [5] Solar capacity was multiplied by a factor of 47 in those five years to reach 3.8 GW, while nuclear capacity increased by a factor of 1.5 to 12 GW. Since 2000, within the European Union nuclear capacity decreased by 14 GW, while 142 GW of renewable capacity was installed, 18 percent more than natural gas with 116 GW. [6]

• Electricity Generation. The quantity of electricity produced by nuclear power plants globally has been increased only slightly over the past decade and as a result its contribution to the global energy mix is decreasing as other sources accelerate production. In 2011 wind turbines produced 330 TWh more electricity than it did at the turn of the century, which is a four times greater increase than was achieved by the nuclear sector over the same period. The growth in solar PV generated power has been impressive in the last decade and especially in the past few years, with a tenfold increase in the past five years. In Germany, for the first time, power production from renewables at 122 TWh (gross), only second to the contribution of lignite 153 TWh, exceeded coal’s 114.5 TWh, nuclear power’s 102 TWh and natural gas’ 84 TWh. The German renewable electricity generation thus corresponded to 29 percent of French nuclear production. One should recall that France generates almost half of the European Union’s nuclear electricity. In China, just five years ago, nuclear plants were producing ten times as much electricity as wind, by 2011 the difference had shrunk to less than 30 percent.

• Grid Parity. Grid parity occurs when the unit costs of renewable energy is equal to the price that end users pay for their electricity. Grid parity for solar photovoltaic power has already happened in a number of markets and regions with particular conditions. Several assessments expect that this will become a worldwide phenomenon within less than a decade. This will radically change the incentives for further large scale expansion of solar facilities around the world.

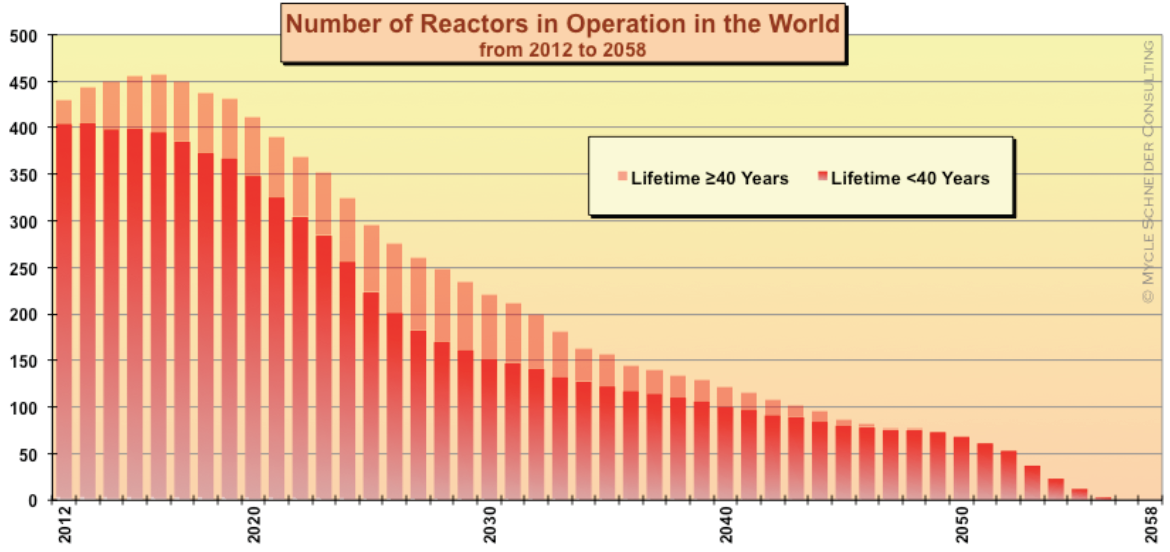

Lifetime Extensions and Stress Tests

As a result of insufficient new capacities coming online, the average age of the world’s operating nuclear fleet continues to increase and now stands at 27 years. Assuming a 40-year lifetime, 67 additional units or 35 GW would have to be ordered, built and commissioned by 2020, beyond the units already under construction, just to maintain the status quo. This is an unlikely scenario, although not entirely impossible, if China were to restart building large numbers of reactors. Furthermore, as our lifetime extension projections illustrate, the systematic prolonged operation of reactors up to licensed limits (up to 60 years) would not fundamentally change the problem of the industry. [7] An additional 19 reactors would have to begin operation in order to break even by 2020, but the installed capacity would be slightly positive (+4 GW). This scenario is possible, but will require a number of specific conditions including that the generalized lifetime extension is technically feasible, economically attractive and publicly and politically acceptable.

Plant life extension seems the most likely survival strategy of the nuclear industry at this point. The French case illustrates this. As the French Court of Audits has calculated, eleven EPRs would have to be built in France by the end of 2022 in order to maintain the current nuclear share. “This seems highly unlikely, if not impossible, including for industrial reasons”, the Court comments and concludes: “This implies one of two things: a) either it is assumed that plants will operate for more than 40 years (…); b) or the energy mix will move towards other energy sources. However, no clear public decision has been made concerning these major strategic issues, even though they call for short-term action and major investments.” An appropriate description for the situation in many nuclear countries.

Serious questions need to be raised about the extent to which the lessons of Fukushima are being even considered by today’s nuclear operators. There are around 400 nuclear power reactors in operation and in the absence of a major new build the nuclear industry is pushing to keep those units operating as long as possible. The fact that one third of the nuclear countries generated their historic maximum of nuclear electricity in 2011 [8] raises the troubling question of the depth of the nuclear safety assessments or so-called “stress tests” carried out around the world after 3/11. This study did not assess safety issues, but if plant life extension becomes the only future for the industry, the pressure on safety authorities will grow substantially.

Conclusion

Prior to the March 2011 (3/11) Fukushima disaster, the nuclear industry had made it clear that it could not afford another major accident. Over the past ten years the industry has sold a survival strategy to the world as the nuclear revival or its renaissance. In reality many nuclear companies and utilities were already in great difficulties before the triple disaster hit the Japanese east coast in 2011.

Fifteen months after 3/11, it is likely that the decline of the industry will only accelerate. Fukushima continues to have a significant impact on nuclear developments everywhere. Fifteen years ago, nuclear power provided over one third of the electricity in Japan, but as of May 2012 the last operating reactor was closed. The Japanese government is facing massive opposition to nuclear power in the country, thus making the restart of any reactors difficult. The controversy over the restart permission for the Ohi reactors in the Kansai region illustrates the dilemma. Germany shut down half of its nuclear fleet after 3/11. Japan and Germany could be leading a new trend. The German direction is clear with the possibility of Japan following: an electricity system based on highly efficient use and renewable energy technologies, even if many questions remain, including the timescale, local versus centralized, grid transformation and smart system development. It appears increasingly obvious that nuclear systems are not competitive in this world, whether from systemic, economic, environmental or social points of view.

The nuclear establishment has a long history of failing to deliver. In 1973-1974, the International Atomic Energy Agency (IAEA) forecasted an installed nuclear capacity of 3,600-5,000 GW in the world by 2000, ten times what it is today. The latest example was from Hans Blix, former Director General of the IAEA, who stated two months after 3/11: “Fukushima is a bump in the road…”. The statement is both crass and far from today’s reality.

Operation and Construction Data as of 1 July 2012 [9]

Operation. There are 31 countries operating nuclear power plants in the world [10], one more than a year ago, with Iran finally starting up the Bushehr reactor that had been under construction since 1975. A total of 429 reactors combine an installed capacity of 364 GWe [11]. These figures assume the final shutdown of the ten Fukushima reactors.

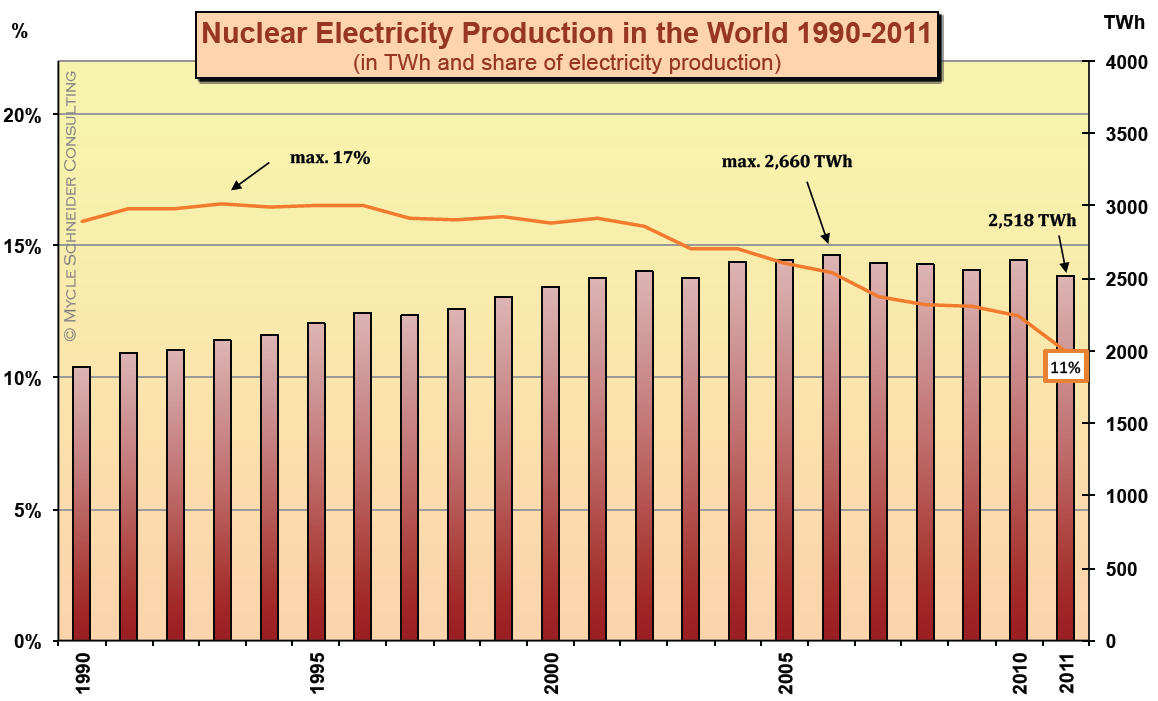

It should be noted that as of 5 July 2012 only one (Ohi-3) of the 44 remaining Japanese reactors is operating and their future is highly uncertain. This compares to the historical maximum of 444 reactors in 2002. Installed capacity peaked in 2010 at 375 GWe before declining to the level of a decade ago. Nuclear electricity generation reached a maximum in 2006 with 2,660 TWh and dropped to 2,518 TWh in 2011 (down 4.3 percent compared to 2010), while the nuclear share in the world’s power generation declined steadily from a historic peak of 17 percent in 1993 to about 11 percent in 2011.

Construction. There are 13 countries currently building nuclear power plants, two fewer than a year ago with Iran starting up its plant and Bulgaria abandoning construction at the two Belene units where work had started in 1987. Japan halted construction at two sites (Ohma and Shimane-3) and Pakistan started construction on two units (Chasnupp-3 and -4). There are currently 59 reactors under construction with a total capacity of 56 GW. However:

• Nine reactors have been listed as “under construction” for more than 20 years.

• Four additional reactors have been listed for 10 years or more.

• Forty-three projects do not have an official (IAEA) planned start-up date.

• At least 18 of the 59 units listed by the IAEA as “under construction” have encountered construction delays, most of them multi-annual. Of the remaining 41 reactor units construction began either within the past five years or they have not reached projected start-up dates yet. This makes it difficult or impossible to assess whether they are on schedule or not.

Nearly three-quarters (43) of the units under construction are located in three countries: China, India and Russia.

Introduction↑

The Chernobyl disaster “caused such a negative opinion of nuclear energy that, should such an accident occur again, the existence and future of nuclear energy all over the world would be compromised.”

World Association of Nuclear Operators (WANO)

1996

The triple disaster earthquake-tsunami-nuclear accident that hit Japan on 11 March 2011 had a profound impact on environmental, economic and energy policy not just in Japan but far beyond. The Japanese people were and are deeply traumatized by the aftermath of the tragedy now widely known as 3/11. Trust in political leaders was shaken, confidence in apparently superior technology destroyed. In China the government froze all new nuclear projects and the public became aware of the nuclear power issue through the disastrous events in its neighbouring country. In South Korea public support for nuclear power plummeted. Governments in many countries are reviewing their nuclear plans. Belgium and Germany confirmed nuclear phase-out legislation by 2025 and 2022 respectively. The Netherlands and Switzerland have abandoned new reactor build projects.

The expression of opposition to nuclear programs is changing. In Japan, on 28 April 2012, 64 mayors and 6 former mayors from 35 prefectures have started a network with the aim of creating communities that do not rely on nuclear energy, with the ultimate aim of achieving a nuclear-free Japan. Members include the heads of the cities of Sapporo, Nagoya, the 3/11-striken town of Minamisoma and Tokyo’s Setagaya Ward as well as Tokai-mura’s mayor. Tokai-mura hosts the nuclear power plant closest to Tokyo, which has not operated since 3/11.

On 5 May 2012, the last operating reactor went offline in Japan. The local authorities play a key role in preventing the restart of nuclear plants in Japan as an unwritten law requires their approval prior to operating. Local authorities have increasingly raised their voices in other countries. In South Korea the mayor of Seoul has vowed to reduce energy consumption of the city in order to save the equivalent of the output of a nuclear reactor. Even in China, a local authority has voiced opposition to the construction of the Pengze nuclear plant in a neighboring district. In France, several dozen municipalities, including the city of Strasbourg, have voted a motion requesting the closure of the Fessenheim nuclear plant.

In 1992, in order to assess the impact of the Chernobyl disaster on the global nuclear industry and the resultant trends, Greenpeace International, WISE-Paris and the Washington based Worldwatch Institute jointly published the first World Nuclear Industry Status Report. “Many of the remaining plants under construction are nearing completion so that in the next few years worldwide nuclear expansion will slow to a trickle”, we wrote. “It now appears that in the year 2000 the world will have at most 360,000 megawatts of nuclear capacity – only ten percent above the current figure.” The actual figure for 2000 was an installed capacity of 356,600 MW. “Not only coal plants, but also new, highly efficient natural gas plants, and new technologies such as wind turbines and geothermal energy, are all substantially less expensive than new nuclear plants. The market niche that nuclear power once held has in effect gone”, we concluded twenty years ago. In 2012, reality has confirmed that assessment and nuclear power’s competitors have most definitely taken over as this latest report demonstrates.

General Overview Worldwide↑

Even before the Fukushima disaster,

the long-awaited nuclear renaissance in the West

seemed to be running out of steam.

Energy Economist

February 2012

As of the middle of 2012, a total of 31 countries were operating nuclear fission reactors for energy purposes—one more than in 2010–11, with Iran finally starting up its Bushehr reactor, construction of which began in 1975. Nuclear power plants generated 2,518 Terawatt-hours (TWh or billion kilowatt-hours) of electricity in 2011 [12], the same as in 2001 and a 112 TWh or 4.3 percent decrease compared to 2010, which is 5.3 percent less than the historic maximum in 2006. The maximum share of nuclear power in commercial electricity generation worldwide was reached in 1993 with 17 percent (see figure 1). It has dropped to 11 percent in 2011, a level last seen in the early 1980s.

This decline in 2011 corresponds to more than the annual nuclear generation in all but five of the nuclear countries. The decline is exclusively caused by the substantial drop in Japan (124 TWh or 44 percent), Germany (31 TWh or 23 percent) and the United States (17 TWh or 2 percent), since in all but five countries nuclear generation actually increased or remained stable in 2011. Ten countries [13] even generated their historic maximum in 2011. Considering the decision in many countries to carry out “stress tests” or other nuclear safety audits at their facilities following the 3/11 events, this is a rather surprising result. It indicates that inspection and analysis did not have any operational impact in most cases, which might suggest the assessments were brief and limited in scope. [14]

The “big six” countries—France, Germany, Japan, Russia, South Korea, and the United States—generated over 70 percent of all nuclear electricity in the world. Two thirds of the 31 countries operating reactors are nevertheless past their nuclear generation peak. The three countries that have phased-out nuclear power (Italy, Kazakhstan, Lithuania), and Armenia, generated their historical maximum of nuclear electricity in the 1980s. Several other countries’ nuclear power generation peaked in the 1990s, among them Belgium, Canada, Japan, and the UK. And six additional countries peaked generation between 2001 and 2005: Bulgaria, France, Germany, South Africa, Spain, and Sweden. Among the countries with a steady increase in nuclear generation are China, the Czech Republic and Russia. However, even where countries are increasing their nuclear electricity production this is often not keeping pace with overall increases in electricity demand leading to a reduced role for nuclear power.

In fact, all nuclear countries—with the exception of Iran that started up its first nuclear plant only in 2011—reached the maximum share of nuclear power prior to 2010. While five countries peaked in 2008 (China) or 2009 (Armenia, Czech Republic, Romania, Russia), the other 25 countries saw their largest nuclear share up to 2005. In total, nuclear power in nine countries played its largest role during the 1980s [15] , in twelve countries in the 1990s and in thirteen countries in the 2000s.

Increases in nuclear generation are mostly as a result of higher productivity and uprating [16] at existing plants rather than to new reactors. According to the latest assessment by Nuclear Engineering International [17], the global annual load factor [18] of nuclear power plants decreased from 77 to 76 percent in 2011. Not surprisingly the biggest change was seen in Japan, where the load factor plunged from an already modest 69.5 percent to 39.5 percent. This is also due to the fact that officially 50 of the 54 pre-3/11 units in Japan are still counted as operational—even though some reactors have not generated electricity for years. [19] In Germany eight units have been officially closed very quickly and thus do not appear in the year-end load factor of 85 percent anymore.

Figure 1: Nuclear Electricity Generation in the World

Source: IAEA-PRIS, BP, MSC, 2012

Taiwan and Romania had the highest load factors in 2011 with 95.5 and 95.4 percent respectively. Russia is generally on an upward trend (now 80 percent) with load factors of the 15 operating Chernobyl-type RBMK (light water cooled, graphite moderated) reactors rising from 60 percent to 81 percent between 2010 and 2011. South Korea is fluctuating at a very high level (90 percent). The U.S. is continuing an excellent average load factor of 86 percent, especially considering its large operating fleet. France at a load factor of 76 percent has increased productivity but remains on the lower end of the performance indicator.

Overview of Operation, Power Generation, Age Distribution↑

There have been two major waves of grid connections since the beginning of the commercial nuclear age in the mid-1950s. (See Figure 2.) A first wave peaked in 1974, with 26 reactor startups. The second wave occurred in 1984 and 1985, the years preceding the Chernobyl accident, reaching 33 grid connections in each year. By the end of the 1980s, the uninterrupted net increase of operating units had ceased, and in 1990 for the first time the number of reactor shutdowns outweighed the number of startups. The 1992-2001 decade showed almost twice as many startups than shutdowns (50/26), while in the past decade 2002-2011 the trend reversed (36/49), notably with 19 units [20] closing and only seven starting up in 2011. [21]

Figure 2. Nuclear Power Reactor Grid Connections and Shutdowns, 1956–2012

Source: IAEA-PRIS, MSC, 2012

As of 1 July 2012, under the Baseline Scenario (see hereunder), a total of 429 nuclear reactors were considered operating in 31 countries, down 15 from the maximum of 444 in 2002. The current world reactor fleet has a total nominal capacity of about 362.5 gigawatts (GW or thousand megawatts). However, there are large uncertainties to these figures, mainly stemming from the undefined future of the 50 Japanese nuclear reactors that are officially still operating but are all shut down as of 1 July 2012. We have therefore considered three scenarios:

• The Baseline Scenario. Only the 10 Fukushima reactors are permanently closed.

• The East Coast Scenario. In addition to the Fukushima units, the seven reactors impacted either directly or indirectly by 3/11 events remain closed. These include three Onagawa reactors that were closest to the 3/11 epicenter, the three remaining Hamaoka units, shut down at the request of former Prime Minister Naoto Kan because of high earthquake risk estimates and the Tokai reactor, the nuclear plant closest to the Tokyo Metropolitan area (ca. 100 km). The total number of operating units in the world would drop to 421 and the installed capacity to 356 GWe.

• The German Scenario. In addition to the units considered closed under the Baseline and East Coast Scenarios the 12 reactors with an operational age in excess of 30 years will remain shut down. The German government decided in the wake of 3/11 to shut down for good the eight reactors that had operated for over three decades. That would leave Japan with 25 operating reactors, the worldwide figure would drop to 409, last seen in 1987, and the installed capacity to 348 GWe, not experienced since the middle of the 1990s.

Considering the opposition in Japan, especially by local authorities under the influence of an increasingly vocal public opinion, against the restart of any nuclear power plant (see Japan Focus for details), it is possible that there will be the short-term closure of the majority of the nuclear program in the country. This would not be a “phase-out” scenario but rather the simple “abandoning” of nuclear power. Every authorization of restart will be subject to intense battles between promoters and opposition of the nuclear option. Under these circumstances, the scenarios above could prove quite conservative.

The total world installed nuclear capacity has decreased only six times since the beginning of the commercial application of nuclear fission, all in the past 15 years—in 1997, 2003, 2007, 2008, 2009 and 2011. Despite 15 fewer units operating in early 2012 compared to 2002, the generating capacity is still about identical. This is a result of the combined effects of larger units replacing smaller ones and, mainly, technical alterations at existing plants, a process known as uprating. In the United States, the Nuclear Regulatory Commission (NRC) has approved 140 uprates since 1977. These included, in 2011, five uprates between 1.6 percent (Surry 1 and 2) and 17 percent (Point Beach 1 and 2) [22]. The cumulative approved uprates in the United States total 6.2 GW. [23] Most of these have already been implemented, and applications for an additional 1.5 GW in increases at 20 units are pending. [24] A similar trend of uprates and lifetime extensions of existing reactors can be seen in Europe. The main incentive for lifetime extensions is their considerable economic advantage over new-build, but upgrading and extending the operating lives of older reactors will result in lower safety margins than replacement with more modern designs.

Figure 3. World Nuclear Reactor Fleet, 1954–2012

Sources: IAEA-PRIS, MSC, 2012

Including uprates in many countries, as well as new-build capacity, net of closures, the capacity of the global nuclear fleet increased by about 30 GWe between 1992 and 2002 to reach 362 GWe; it peaked in 2010 at 375 GWe before falling back to the level achieved a decade ago.

The use of nuclear energy has been limited to a small number of countries, with only 31 countries, or 16 percent of the 193 members of the United Nations, operating nuclear power plants in early 2012 (see Figure 4). One new country, Iran, started operating its first nuclear power reactor in 2011. Iran is the first in 15 years to join the list of countries generating electricity from fission since Romania joined the nuclear club in 1996. Half of the world’s nuclear countries are located in the European Union (EU), and they account for nearly half of the world’s nuclear production. France alone generates about half (49 percent) of the EU’s nuclear production.

Figure 4. Nuclear Power Generation by Country, 2011

Source: IAEA-PRIS, MSC, 2012

Overview of Current New Build↑

Currently, 13 countries are building nuclear power plants, which is two less than a year ago:

• Iran finally started operating its only reactor that had been under construction at Bushehr since 1975. No further active building is currently ongoing.

• Bulgaria abandoned the construction of the only two units at Belene, which it had been building since 1987.

• Japan halted work at two units following the 3/11 events, Ohma and Shimane-3, which had been under construction since 2007 and 2010 respectively. No further project is underway or planned at this stage.

• Pakistan started construction at Chasnupp-3 in late May 2011, two months after the connection of Chasnupp-2 to the grid in March only three days after 3/11.

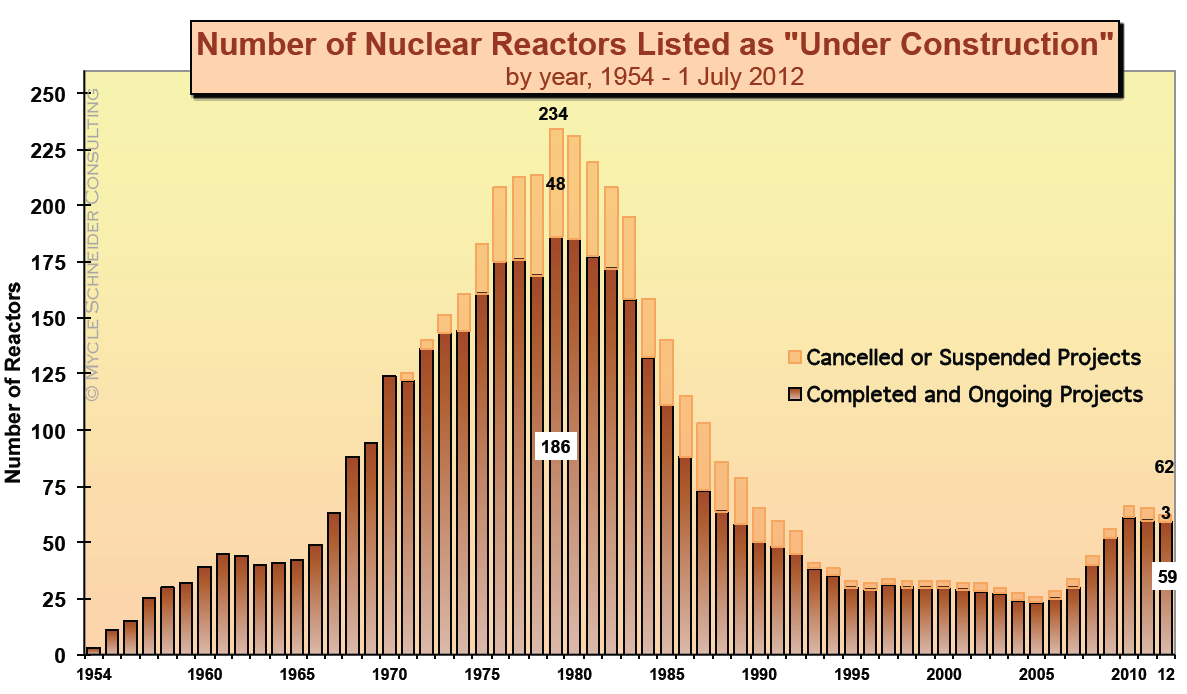

In addition we have removed the Russian Kursk-5 unit from the list, following reports that the builder, Rosatom, confirmed abandoning the project. It was intended to be an upgraded version of the Chernobyl RBMK design. [25] As of 1 May 2012, we consider 59 reactors under construction. The current number compares with a peak of 234 units in building progress—totaling more than 200 GW—in 1979. However, many of those projects (48) were never finished (see Figure 5.) The year 2004, with 26 units under construction, marked a record low for construction since the beginning of the nuclear age in the 1950s.

Over the past year, the most spectacular construction freeze took place in China. No new concrete base has been poured in the country after 3/11. The World Nuclear Association assumes that at least five authorized construction starts did not happen, with at least another ten that were in the pipeline for that year. [26]

Figure 5. Number of Nuclear Reactors under Construction

Source: IAEA-PRIS, MSC 2012

The total capacity of units now under construction in the world is about 56 GWe, down by about 6 GWe compared to a year ago, with an average unit size of around 955 MW. (See Table 1 and Annex 4 for details.) A closer look at currently listed projects illustrates the level of uncertainty associated with reactor building, especially given that most constructors assume a five year construction period:

• Nine reactors have been listed as “under construction” for more than 20 years. The U.S. Watts Bar-2 project in Tennessee holds the record, as construction started in December 1972, but was subsequently frozen. It has now failed to meet the latest startup date in 2012 and is now scheduled to be connected to the grid in 2015. Other long-term construction projects include three Russian units, two Mochovce units in Slovakia, and two Khmelnitski units in Ukraine. The construction of the Argentinian Atucha-2 reactor started 31 years ago.

• Four reactors have been listed under-construction for 10 years or more. These are two Taiwanese units at Lungmen for about 13 years and two Indian units at Kudankulam for around 10 years.

• Forty-three projects do not have an IAEA planned start-up date, including nine of the 10 Russian projects and all of the 26 Chinese units under construction.

• At least 18 of the units listed by the IAEA as “under construction” have encountered construction delays, most of them significant. All of the 41 remaining units were started within the last five years or have not reached projected start-up dates yet. This makes it to assess whether they are on schedule.

• Nearly three-quarters (43) of the units under construction are located in just three countries: China, India and Russia. Furthermore, there are only these three countries, plus South Korea, that have construction taking place at more than one power plant site. None of these countries has historically been very transparent or reliable about information on the status of their construction sites. It is nevertheless known that half of the Russian units listed are experiencing multi-year delays.

The geographical distribution of nuclear power plant projects is concentrated in Asia and Eastern Europe, continuing a trend from earlier years. Between 2009 and 1 May 2012, a total of 14 units were started up, all in these two regions.

The lead time for nuclear plants includes not only construction times but also lengthy licensing procedures in most countries, complex financing negotiations, and site preparation.

In most cases the grid system will also have to be upgraded—often using new high-voltage power lines, which bring their own planning and licensing difficulties. In some cases, public opposition is significantly higher for the long-distance power lines than for the nuclear generating station itself. Projected completion times should be viewed skeptically, and past nuclear planning estimates have rarely turned out to be accurate.

Table 1: Nuclear Reactors “Under Construction” (as of 1 July 2012) [27]

| Country | Units | MWe (net) | Construction Start | Grid Connection |

|---|---|---|---|---|

| China | 26 | 27,4 | 2007-2010 | 2012-2016 |

| Russia | 10 | 8,258 | 1983-2012 | 2013-2017 |

| India | 7 | 4,824 | 2002-2011 | 2013-2016 |

| South Korea | 3 | 3,64 | 2008-2009 | 2013-2014 |

| Pakistan | 2 | 630 | 2011 | 2016-2017 |

| Slovakia | 2 | 782 | 1985 | 2012-2013 |

| Taiwan | 2 | 2,6 | 1999 | 2016 |

| Ukraine | 2 | 1,9 | 1986-1987 | 2015-2016 |

| Argentina | 1 | 692 | 1981 | 2012 |

| Brazil | 1 | 1,245 | 2010 | 2018 |

| Finland | 1 | 1,6 | 2005 | 2014 |

| France | 1 | 1,6 | 2007 | 2016 |

| USA | 1 | 1,165 | 1972 | 2015 |

| Total | 59 | 56,336 | 1972-2012 | 2012-2018 |

Source: IAEA-PRIS, MSC, 2012

Past experience shows that simply having an order for a reactor, or even having a nuclear plant at an advanced stage of construction, is no guarantee for grid connection and power supply. The French Atomic Energy Commission (CEA) statistics on “cancelled orders” through 2002 indicate 253 cancelled orders in 31 countries, many of them at an advanced construction stage. (See also Figure 5.) The United States alone account for 138 of these cancellations. [28] Many U.S. utilities incurred significant financial harm because of cancelled reactor-building projects.

In the absence of any significant new build and grid connection over many years, the average age (since grid connection) of operating nuclear power plants has been increasing steadily and now stands at about 27 years. [29] Some nuclear utilities envisage average reactor lifetimes of beyond 40 years and even up to 60 years.

In the United States, reactors are initially licensed to operate for a period of 40 years. Nuclear operators can request a license renewal for an additional 20 years from the Nuclear Regulatory Commission (NRC). As of March 2012, 72 of the 104 operating U.S. units have received an extension, another 15 applications are under review by the NRC.

Many other countries, however, have no time limitations to operating licenses. In France, where the country’s first operating PWR started up in 1977, reactors must undergo in-depth inspection and testing every decade. The French Nuclear Safety Authority (ASN) evaluates on a reactor-by-reactor basis whether a unit can operate for more than 30 years. At this point, ASN considers the issue of lifetimes beyond 40 years to be irrelevant, although the French utility EDF has clearly stated that, for economic reasons, it plans to prioritize lifetime extension over large-scale new build. In fact, only two plants (Fessenheim, Tricastin) have so far received a permit to extend operational life from 30 to 40 years, but only under the condition of significant upgrading. President François Hollande vowed during his election campaign, to close down the Fessenheim reactors during his term of office. However, even if ASN gave the go-ahead for all of the oldest units to operate for 40 years, 22 of the 58 French operating reactors will reach that age by 2020. The French Cour des Comptes (Court of Audits) has calculated that 11 EPRs would have to be built by the end of 2022, if the same level of nuclear generation was to be maintained. “This seems highly unlikely, if not impossible, including for industrial reasons”, the Cour des Comptes comments before concluding: “This implies one of two things: a) either it is assumed that plants will operate for more than 40 years (…); b) or the energy mix will move towards other energy sources. However, no clear public decision has been made concerning these major strategic issues, even though they call for short-term action and major investments.” [30] It remains to be seen how the incoming administration will deal with the issue in France.

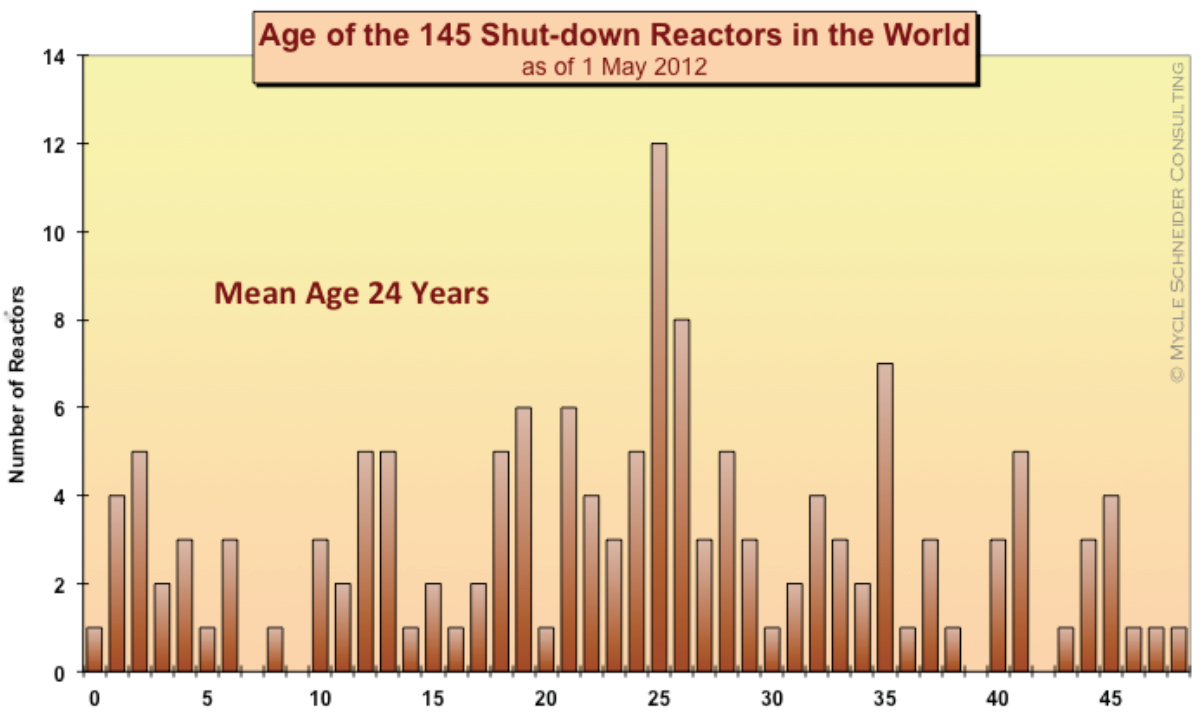

In assessing the likelihood of reactors being able to operate for up to 60 years, it is useful to compare the age distribution of reactors that are currently operating with those that have already shut down. (See Figures 6 and 7.) At present, 20 of the world’s operating reactors have exceeded the 40-year mark. [31] As the age pyramid illustrates, that number will rapidly increase over the next few years. Twelve additional units have reached age 40 in 2011 (one of which is now retired), and two in the beginning of 2012, while a total of 159 units have reached age 30 or more, and 17 more will do so in 2012.

The age structure of the 145 units already shut down confirms the picture. In total, 43 of these units operated for 30 years or more; and within that subset, 19 reactors operated for 40 years or more. (See Figure 7.) The majority of these were Magnox reactors located in the U.K.. As they had been designed to produce weapons-grade plutonium, these were all small reactors (50–490 MW) that had operated with very low burn-up fuel. Therefore there are significant differences from the large 900 MW or 1,300 MW commercial reactors that use high burn-up fuel that generates significantly more stress on materials and equipment.

Many units of the first generation have operated for only a few years. Considering that the average age of the 145 units that have already shut down is about 24 years, plans to extend the operational lifetime of large numbers of units to 40 years and beyond seem rather optimistic.

Figure 6. Age Distribution of Operating Nuclear Reactors, 2012

Sources: IAEA-PRIS, MSC, 2012

Figure 7. Age Distribution of Shutdown Nuclear Reactors, 2012

Sources: IAEA-PRIS, MSC, 2011

After the Fukushima disaster questions have been raised about the wisdom of operating older reactors. .The Fukushima-I units (1 to 4) were connected to the grid between 1971 and 1974. The license for unit 1 was extended for another 10 years in February 2011. Four days after the accidents in Japan, the German government ordered the shutdown of seven reactors that had started up before 1981. These reactors, together with another unit that was closed at the time, never restarted. The exclusive selection criterion was operational age. Other countries did not follow the same way, but it is clear that the 3/11 events had an impact on previously assumed extended lifetimes also in other countries, including Belgium, Switzerland and Taiwan.

For the purposes of capacity projections, in a first scenario (40-Year Lifetime Projection), we have assumed a general lifetime of 40 years for worldwide operating reactors, with a few adjustments, while we take into account authorized lifetime extensions in a second scenario (PLEX Projection). In our scenarios in the previous report, in order to remain conservative, we had assumed, for example, that all 17 German units would be operated with remaining lifetimes between 8 and 14 years. Eight of these have now been shut down definitively. Similarly, in the present projections there are several individual cases where continued operation or lifetime extensions are in question and earlier shutdowns have been officially decided. [32] (See Figure 8.)

Figure 8. The 40-Year Lifetime Projection

Sources: IAEA-PRIS, WNA, MSC 2012

The lifetime projections make possible an evaluation of the number of plants that would have to come on line over the next decades to offset closures and maintain the same number of operating plants. Inspite of the 59 units under construction—as of 1 July 2011, all of which are considered online by 2020—installed nuclear capacity would drop by 35 GW. Therefore in total 67 additional reactors would have to be finished and started up prior to 2020 in order to maintain the status quo. [33] This corresponds to two new grid connections every three months, with an additional 209 units (192 GW) over the following 10-year period—one every 19 days.

This achievement of the 2020 target appears unlikely given existing constraints on the manufacturing of key reactor components, the difficult financial situation of the world’s main reactor builders and utilities, the general economic crisis and generally hostile public opinion—aside from any other specific post-Fukushima effects. As a result, the number of reactors in operation will decline over the coming years unless lifetime extensions beyond 40 years becomes widespread. The scenario of such generalized lifetime extensions is in our view even less likely after Fukushima, as many questions regarding safety upgrades, maintenance costs, and other issues would need to be much more carefully addressed.

Developments in Asia, and particularly in China, do not fundamentally change the global picture. Reported figures for China’s 2020 target for installed nuclear capacity have fluctuated between 40 GW and 120 GW. However, the average construction time for the first 15 operating units was 5.8 years. At present, about 27 GW are under construction. While there has been considerable acceleration of construction starts in the past—with 18 new building sites initiated in 2009 and 2010—not a single new construction site was initiated since 3/11. The prospects for significantly exceeding the original 2008 target of 40 GW for 2020 now seems unlikely, even if an 80 GW target has resurfaced recently (see China Focus). China has reacted surprisingly rapidly and strongly to the Fukushima events by temporarily suspending approval of nuclear power projects, including those under development.

We have modeled a scenario in which all currently licensed lifetime extensions and license renewals (mainly in the United States) are maintained and all construction sites are completed. For all other units we have maintained a 40-year lifetime projection, unless a firm earlier or later shutdown date has been announced. The net number of operating reactors would still decrease by 16 units even if installed capacity would grow by 6.5 GW in 2020. The overall pattern of the decline would hardly be altered, it would merely be delayed by some years. (See Figures 9 and 10).

Figure 9. The PLEX Projection

Sources: IAEA-PRIS, US-NRC, WNA, MSC 2012

Figure 10. Forty-Year Lifetime Projection versus PLEX Projection (in numbers of reactors)

Sources: IAEA-PRIS, US-NRC, MSC 2012

Potential Newcomer Countries↑

In 2010, the IAEA announced that 65 countries had expressed an interest, were considering, or were actively planning for nuclear power, up from an estimate of 51 countries in 2008. [34] Since 2010 the IAEA has not published a comprehensive updated analysis, but it stated it expects Vietnam, Bangladesh, United Arab Emirates, Turkey and Belarus to start building their first nuclear power plants in 2012 and that Jordan and Saudi Arabia could follow in 2013 [35]. This would seem extremely optimistic given the current situation in these countries.

In the 25 years since the accident at Chernobyl, only four countries—Mexico, China, Romania and Iran—have started new nuclear power programs [36]. (See Figure 11.) While over the same period three others—Italy, Kazakhstan, and Lithuania—have closed all their reactors.

The IAEA continues its activities to support the introduction of nuclear power programs and tries to overcome the negative Fukushima impact on public opinion. Participants from 43 countries attended the Sixth Annual Workshop on Nuclear Power Infrastructure at the IAEA in January 2012. “Those countries with a strong national position on introducing nuclear power, however, are still committed to developing their national nuclear infrastructure” said Masahiro Aoki [37] from the IAEA’s Integrated Nuclear Infrastructure Group (INIG) [38], and the Scientific Secretary of the meeting. “The factors that contribute to interest in nuclear power in these countries have not changed, such as energy demand, concerns about climate change, volatile fossil fuel prices and security of the energy supply”, Aoki explained. [39] There are many stages to the development of nuclear power and many countries that propose or even embark upon nuclear construction, such as Austria and the Philippines, which in the end do not start up a reactor. In fact, under the headline “what are the problems we are trying to solve?”, INIG’s Aoki in a 2011 presentation [40] appropriately lists:

• Never moving beyond planning stage

• Focusing on specific issues but missing the big picture

• Inviting bids with no appropriate response

• Developing unsustainable nuclear power programme

Figure 11. Start-ups and Closures of National Nuclear Power Programs, 1950–2011

Sources: IAEA-PRIS 2012, MSC, 2012

Below is an assessment by country of the status of the projects that the IAEA has referred to, which indicates that most are much further from the launch of their program than the IAEA frequently suggests.

Press reports indicate that Bangladesh has agreed to build two nuclear power plants with Russian assistance; they quote Science Minister Yeafesh Osman as saying “we have signed the deal… to ease the power crisis”. He said that construction of the plants would start by 2013 and would take five years to complete [41]. The agreement is for two 1 000 megawatt-electric (MWe) units as well as fuel supply, take-back of spent fuel, training and other services. The Government of Bangladesh is considering either a government-owned turnkey project or a Build-Own-Operate-Transfer (BOOT) contract [42]. The Russian contractor would be Rosatom subsidiary Atomstroyexport and the Bangladesh Atom Energy Commission the client. No information is available on the value of the contract. Negotiations started in February 2012. [43] The trade journal Nuclear Intelligence Weekly reported the same month that there was “no financing yet” for implementing the agreement. [44]

In mid-2006, the government of Belarus, which, 20 years before, was heavily impacted by the Chernobyl accident, approved a plan for construction of a nuclear power plant originally to be built in the Mogilev region in the country’s east, but now at a site in the district of Astravets. An agreement with Russia on cooperation in the construction of a nuclear power plant in Belarus was signed on 15 March 2011, four days after 3/11. Expressions of interest were sought from international companies, and, not surprisingly given the existing economic and political ties, a bid from Russia’s Atomstroyexport was taken forward. Under a financing agreement, Russia would provide a $9 billion [45] loan. Prior to 3/11, the two countries reportedly aimed at the signature of an agreement on plant construction in spring 2011, with construction starting that September. [46] In November 2011 it was agreed that Russia would lend up to $10 billion for 25 years to finance 90 percent of the contract between Atomstroyexport and the Belarus Directorate for Nuclear Power Plant Construction. In February 2012 Russian state-owned Vnesheconombank (VEB) and Belarusian commercial bank Belvnesheconombank signed an agreement needed to implement the Russian export credit facility [47]. A contract has reportedly been signed for the design of the nuclear power plant with Atomstroyexport starting working on the design. This phase is scheduled to be completed by mid-2013 with concreting work to start in September 2013. The first unit is to be operational in 2017. [48] In August 2011, the Ministry of Natural Resources and Environmental Protection of Belarus stated that the first unit would be commissioned in 2016 and the second one in 2018. Both would be of the Generation-3+ VVER “NPP-2006”type with a capacity of 1170 MW each. [49] Apparently, Rosatom has offered 100 percent financing. [50] Opposition to the project is increasing. This includes protests from the neighbouring country of Lithuania as the proposed site is 50 km from Vilnius. On the 26th anniversary of the Chernobyl catastrophe, about one thousand people demonstrated in the Belarussian capital Minsk against the nuclear project. [51]

Turkey has a long history of attempting to build a nuclear power program, starting in the early 1970s. In 1996, a call for tender was launched for the construction of 2 GW of nuclear capacity at the Akkuyu site along the eastern Mediterranean. Several international bids were received, including from Westinghouse, AECL, Framatome, and Siemens. In 2000, however, the bid was abandoned. [52] In 2006, the government revised the nuclear initiative and announced plans for up to 4.5 GW of capacity at Akkuyu and at the Black Sea site of Sinop. The plans met with large-scale local protests.

The following year, Turkey approved a bill introducing new laws on the construction and operation of nuclear power plants, which led in March 2008 to a revised tender process for the Akkuyu plant. Only one bid was received jointly from Atomstroyexport and Inter RAO (both from Russia) and Park Teknik (Turkey) for an AES-2006 power plant with four 1200 MW reactors. In May 2010, the Russian and Turkish heads of state signed an intergovernmental agreement for Rosatom to build, own, and operate the Akkuyu plant with four 1200 MW AES-2006 units—a project reported to be worth $20 billion. [53] In December 2011, the project company filed applications for construction permits and a power generation license, as well as for an environmental impact assessment, with a view to starting construction in 2013. The reactors are planned to enter service at yearly intervals in the period 2018–21. [54] If this project was fully realized, then nuclear power would represent five percent of the installed electricity generating capacity by 2023. In March 2010, Turkey also signed an agreement with Korea Electric Power Corporation (KEPCO) to prepare a bid for the Sinop plant. However, the parties failed to reach an agreement because of “differences in issues including electricity sales price.” [55] Negotiations switched to Toshiba, with the support of the Japanese government, and in December 2010 the parties signed an agreement to prepare a bid for development. A French consortium of AREVA and GDF Suez has also indicated an intention to bid for the project, as has French state utility EDF and the Chinese Guangdong Nuclear Power Company (CGN). In November 2011 the prime minister requested the South Korean president to renew the KEPCO bid [56]. Yet another candidate entered the process when, on 24 April 2012, Turkish state utility EUAS signed a memorandum of understanding with the Canadian firm CANDU –AECL (now owned by SNC-Lavalin) that covers a feasibility study for a 4-unit nuclear plant at Sinop. There are still ongoing discussions about the reactor technologies involved in the various offers. However, as the trade journal Nuclear Intelligence Weekly points out, “the deciding factor in Ankara will almost certainly not be the technology as much as the financing that comes with it”. [57] After all, even 100 percent pre-financing arrangements have not allowed for the decades long nuclear project in Turkey to be implemented. In addition, state owned utility EUAS could very well suffer from the downgrading by credit-rating agency Standard & Poor’s of Turkey’s credit rating BB long-term outlook from positive to stable.

Opposition to nuclear power in Turkey remains very high. In June 2011, 80 percent of people polled were in favour of abandoning all new nuclear construction, with 77 percent considered nuclear power only a “limited and soon obsolete” option. [58]

To date, Jordan has signed nuclear cooperation agreements with 12 countries. In February 2011, the country’s energy minister announced that the Jordan Atomic Energy Commission (JAEC) had preselected designs from AECL of Canada, Atomstroyexport of Russia, and a joint venture between AREVA and Mitsubishi—called ATMEA—for the country’s first nuclear reactor, located at Majdal. On 30 June 2011, JAEC accepted the technical bids and the winning firm was supposed to be announced in December 2011 [59]. On 1 May 2012, JAEC issued a statement saying it had “concluded that ATMEA-1 and AES-92 [Atomstroyexport] technologies are the best two evaluated contenders in meeting the requirements and needs of Jordan”, as specified in the terms of the tender. [60] A potential site, located in the Mafraq Governorate, 40 km from the capital, was announced in February 2012 [61].

However, on 30 May 2012, the Jordanian parliament voted a recommendation to shelve the program, which “will drive the country into a dark tunnel and will bring about an adverse and irreversible environmental impact”. The parliament also recommended suspending uranium exploration until a feasibility study is done. [62] Prior to the vote, the Parliament’s Energy Committee had published a report accusing JAEC of deliberately “misleading” the public and officials over the program by “hiding facts” related to costs [63]. Nuclear power has the highest water consumption of all electricity generating technologies, while Jordan is amongst the world’s most water poor nations. The Jordanian electricity grid is far below the minimum size necessary to be able to take up a large power plant. Total installed generating capacity was 2,750 MW by the end of 2010. Financing remains unclear and opposition to the project reaches into the royal family [64].

In August 2009 the Kingdom of Saudi Arabia announced that it was considering launching a nuclear power program, and in April 2010 a royal decree said: “The development of atomic energy is essential to meet the Kingdom’s growing requirements for energy to generate electricity, produce desalinated water and reduce reliance on depleting hydrocarbon resources.” [65] The King Abdullah City for Atomic and Renewable Energy (KA-CARE) is being set up in Riyadh to advance this agenda and to be the competent agency for treaties on nuclear energy signed by the Kingdom. It is also responsible for supervising works related to nuclear energy and radioactive waste projects. In June 2010 it appointed the Finland- and Switzerland-based Pöyry consultancy firm to help define “high-level strategy in the area of nuclear and renewable energy applications” with desalination. In June 2011 the coordinator of scientific collaboration at KA-CARE said that it plans to construct 16 nuclear power reactors over the next 20 years at a cost of more than 300 billion riyals ($80 billion).

The first two reactors would be planned to be on line in ten years and then two more per year until 2030. [66] However, according to a World Energy Council survey, “Saudi Arabia reported that using nuclear is still under consideration and that the WNA figures given above [16 reactors, 20 GW] are speculative.” [67] The assessment confirms reports that the KA-CARE nuclear proposal has still not been approved by the country’s top economic board, headed by King Abdullah. [68]

Saudi Arabia has very large electricity expansion projects. It plans to double installed capacity to 100 GW by 2021, mainly through fossil fuels, but with a 10 percent renewable target by 2020. There is a US$100 billion state spending commitment over the next ten years on renewables and nuclear combined. [69]

Senior Saudi Arabian diplomats have reportedly stated that “if Iran develops a nuclear weapon, that will be unacceptable to us and we will have to follow suit”, and officials in Riyadh have said that the country would reluctantly push ahead with their own civilian nuclear program. [70] Independent experts have suggested that the drive for civil nuclear power in the region is seen by some as a “security hedge”, and that “if Iran was not on the path to a nuclear weapon capability you would probably not see this [civil nuclear] rush”. [71]

Saudi public opinion remains surprisingly critical and 70 percent oppose nuclear construction. However, a majority of 54 percent considers nuclear power a viable long-term option, only one of two countries (with Russia) with an optimistic majority in a 24-country opinion survey. [72]

In October 2010, Vietnam signed an intergovernmental agreement with Russia’s Atomstroyexport to build the Ninh Thuan 1 nuclear power plant, using 1200 MW sized reactors. Construction is slated to begin in 2014, and the turnkey project will be owned and operated by the state utility Electricity of Vietnam (EVN), with operations beginning in 2020. [73] Rosatom has confirmed that Russia’s Ministry of Finance is prepared to finance at least 85 percent of this first plant, and that Russia will supply the new fuel and take back used fuel for the life of the plant. An agreement for up to $9 billion finance was signed in November 2011 with the Russian government’s state export credit bureau, and a second agreement covered the establishment of a nuclear science and technology center. [74]

Vietnam has also signed an intergovernmental agreement with Japan for the construction of a second nuclear power plant in Ninh Thuan province, with its two reactors to come on line in 2024–25. The agreement calls for assistance in conducting feasibility studies for the project, low-interest and preferential loans for the project, technology transfer and training of human resources, and cooperation in the waste treatment and stable supply of materials for the whole life of the project. In July 2011 the government issued a master plan specifying Ninh Thuan 1 & 2 nuclear power plants with a total of eight 1000 MWe-class reactors, one coming on line each year 2020-27, then two more larger ones to 2029 at a central location. By 2020 nuclear power is supposed to represent 1 percent of the Vietnamese electricity production. However, already in November 2010, Wood Mackenzie analysts stated that the lack of finances and skilled labor would delay the first plants to come online to 2028 at the earliest. [75]

The United Arab Emirates (UAE) has the most advanced new nuclear development plans in the Middle East. In April 2008, the UAE published a nuclear energy policy that stated that nuclear power was a proven, environmentally promising and commercially competitive option that “could make a significant base-load contribution to the UAE’s economy and future energy security.” [76] The policy proposed installing up to 20 GW of nuclear energy capacity, including 5 GW by 2020, which would then represent about 22 percent of total planned installed power generating capacity. This would require the operation of four reactors, two between Abu Dhabi city and Ruwais, one at Al Fujayrah, and possibly one at As Sila.

A joint-venture approach, similar to that developed for the water and conventional power utilities, was proposed in which the government would retain a 60 percent share and a private company a 40 percent share. A call for bids in 2009 resulted in nine expressions of interest and the short listing of three companies: AREVA (France) with GDF-SUEZ, EDF, and Total, proposing EPRs; GE-Hitachi (U.S.-Japan), proposing ABWRs; and a South Korean consortium, proposing APR–1400 PWRs. In December 2009, the Korean consortium was awarded the $20 billion contract for the construction and first fuel loads of four reactors, reportedly because the consortium could demonstrate the highest capacity factors, lowest construction costs, and shortest construction times. The trade press considers that “it remains to be seen whether South Korea’s bid was realistic, or whether it was seriously under-priced”. The outcome might be fatal: “If things go wrong, Korea’s entry to the nuclear export market could be short-lived.” [77] Indeed, updated cost estimates are reportedly already skyrocketing between $36 billion and “closer to $40 billion”. [78] Financing negotiations have been delayed into the second half of 2012 and a final approval for construction is now unlikely before the end of the year.

The public in the UAE has raised almost no objection to the announced nuclear energy policy, which has been sold as a way to relieve pressure on the country’s fossil fuel resources, increase the security of electrical power supply, create employment and a high-tech industry, and reduce carbon emissions. In July 2010, a site-preparation license and a limited construction license were granted for four reactors at a single site at Braka, along the coast 53 kilometers from Ruwais. [79] The application is based substantially on the safety analysis prepared for South Korea’s Shin–Kori units 3 and 4, the “reference plant” for the UAE’s new build program. A tentative schedule published in late December 2010, and not put into question since, projects that Braka-1 will start commercial operation in 2017 with unit 2 operating from 2018. In March 2011 a groundbreaking ceremony was held to mark the start of construction.

Other countries that have undertaken steps to develop a nuclear program include:

Since the mid-1970s, Indonesia has discussed and brought forward plans to develop nuclear power, releasing its first study on the introduction of nuclear power, supported by the Italian government, in 1976. The analysis was updated in the mid-1980s with help from the IAEA, the United States, France and Italy. Numerous discussions took place over the following decade, and by 1997 a Nuclear Energy Law was adopted that gave guidance on construction, operation, and decommissioning. A decade later, the 2007 Law on National Long-Term Development Planning for 2005–25 stipulated that between 2015 and 2019, four units should be completed with an installed capacity of 6 GW. [80] Discussions with nuclear vendors have included the possibility of using Russian floating reactors but appear to be dominated by Japanese and South Korean companies; however, neither financing nor detailed planning appear to be in place. In contrast to this nuclear stasis, in 2011, Indonesia showed the fastest growth rate—520 percent—in clean energy investments of any G20 country, exceeding the $1 billion mark for the first time. Much of the investment went into the exploitation of the country’s vast resources in geothermal energy (40 percent of the world’s known resources). [81]

Poland planned the development of a series of nuclear power stations in the 1980s and started construction of two VVER 1000/320 reactors in Zarnowiec on the Baltic coast, but both construction and further plans were halted following the Chernobyl accident. In 2008, however, Poland announced that it was going to re-enter the nuclear arena. In November 2010, the government adopted the Ministry of Economy’s Nuclear Energy Program, which was submitted to a Strategic Environmental Assessment. Poland aims to build 6 GW of nuclear power with the first reactor starting up by 2020. Officials have revised the planning in the meantime targeting 2022-23 for the startup of the first reactor. Financing of the ambitious project remains unclear and public opinion is highly uncertain. While Poland was the only country showing a majority in favor of nuclear new build in a 24-country opinion survey in June 2011 [82], a local referendum in February 2012 in Mielno, one of three pre-selected, potential sites, showed a surprising 94 percent opposed to the plan. The Polish government reacted by starting a $6 million public propaganda campaign, labeled “Meet the Atom”. “We want to make sure that the first Polish nuclear power plant is established with the approval of Polish society”, Hanna Trojanowska, vice minister and government commissioner for nuclear energy stated late March 2012. [83] The director of external relations for the state utility PGE, that promotes the project, stated that “obviously we will not proceed against the will of local people”. [84] The technology selection process is supposed to reduce the choice to three potential designs by the end of 2012 with first concrete to be poured by 2017. Potential vendors are expected to present “an optimum mix of ECA [Export Credit Agency] support and local delivery of the project”. [85]

In its Power Development Plan for 2010–30, approved in 2010, Thailand proposes the construction of 5 GW of nuclear capacity. Currently, five locations are being considered as part of a feasibility study that was supposed to be completed by the end of 2010 but which has now been delayed. This may be due in part to “vociferous opposition” [86] to proposed plant sitings, which reportedly have reduced the number of possible locations to two or three areas. [87] Consultancy firm Wood Mackenzie estimates that Thailand will not even be able to introduce a nuclear safety regulatory framework until 2026. Other key problems are the lack of financing and skilled personnel. [88] Following the Fukushima accident, plans were put on hold so that the first reactor would now be expected on line in 2023 [89]. In reality, prospects for Thailand building a nuclear plant seem to be finished. “Prospects for nuclear power likely saw the final nail in the coffin with the Fukushima disaster”, concludes Power Engineering International. [90]

While public opposition and financing remain two of the key problems of any new-build projects, it is remarkable that the Russian group Rosatom has offered up to 100 percent financing at least in the cases of new build projects in Belarus, Czech Republic, Turkey and Vietnam. Rosatom remains also a contender in Jordan. It remains to be seen whether cross-subsidization from the gas sector will be sufficient to finance the Russian nuclear ambitions inside and outside the country. Given the past history of nuclear ambitions not materializing, there are serious doubts as to how much of these will be realized.

Projects and programs officially abandoned in 2011↑

In Egypt, the government’s Nuclear Power Plants Authority was established in the mid-1970s, and plans were developed for 10 reactors by the end of the twentieth century. Despite discussions with Chinese, French, German, and Russian suppliers, little specific development occurred for several decades. In October 2006, the Minister for Energy announced that a 1,000 MW reactor would be built, but this was later expanded to four reactors by 2025, with the first one coming on line in 2019. In early 2010, a legal framework was adopted to regulate and establish nuclear facilities; however, an international bidding process for its construction was postponed indefinitely in February 2011 due to the political situation in the country.

All of Italy’s nuclear power plants were closed following a post-Chernobyl referendum in 1987. This has not stopped the country’s largest electricity utility, ENEL, from buying into nuclear power projects in other countries, including France, Slovakia, and Spain. In May 2008, the government introduced a package of nuclear legislation that included measures to set up a national nuclear research and development entity, to expedite licensing of new reactors at existing nuclear power plant sites, and to facilitate licensing of new reactor sites. ENEL and EDF had subsequently stated that they intended to build four EPR reactors by 2020. In January 2011, however, the Constitutional Court ruled that Italy could hold a referendum on the planned reintroduction of nuclear power. The question posed in the June 2011 referendum, was whether voters want to cancel some of the nuclear legislative and regulatory measures that have been taken by the government over three years. [91] The referendum motion was supported by 94 percent of the population, ending Italy’s new nuclear ambitions.

Kuwait country had announced plans to invest in nuclear energy as far back as 2009, signing accords with the U.S., France and Russia to boost cooperation in atomic energy. In September 2010, Kuwait’s National Nuclear Energy Committee told Reuters it was considering options for four planned 1,000 megawatt reactors, and would release a “roadmap” for developing atomic power in January 2011 [92]. One year later it as announced that Kuwait had abandoned its nuclear program according to officials from a Kuwaiti government research quoted in the Japan Times [93].

Unfulfilled Promises↑

The nuclear establishment, industry, utilities and their promoters in business and politics have a long history of over selling their technology and ‘promising the impossible’. As a result the history of the nuclear age is littered of examples of fantasy projections for installed nuclear capacity and failures to construct to time and budget.

Unrealistic Projections ↑

In 1973-1974, the IAEA gave a forecast of installed nuclear capacity of 3,600-5,000 GW worldwide by 2000. [94] Two years later the French Atomic Energy Commission (CEA) estimated the share of nuclear power in the world’s primary energy balance at 22-35 percent by the turn of the century. [95] These optimistic projections were soon to be confronted reality and in 1982, Hans-Jürgen Laue, the Director of the IAEA’s Nuclear Power Division, lamented:

There has been a steady decline in projections for the short-term (1975 and 1980) and since 1975, a dramatic decrease in the projections for the longer term (1990 and 2000).

Although the 1990 capacity projections show signs of ‘bottoming out’, some recent studies indicate that the actual turnout in 2000 could be as much as 20 percent lower than the projection reported by the Agency in 1980. [96]

However, no “bottoming out” took place and the IAEA’s 1980 projections of 740-1,075 GWe installed nuclear power capacity for the year 2000 were a factor of two to three above the actual figure of 356 GWe. Current operation remained a factor of 10 to 14 below the 1973-74 projections. Even after Chernobyl, the OECD Nuclear Energy Agency forecasted an installed nuclear capacity of 497-646 GWe for the year 2000, still between 40 and over 80 percent above reality. [97] Considering the long lead times of nuclear projects of 10 to 15 years, the failure of these specialized international agencies to develop accurate short-term projections casts doubt on their analytic capability or independence or both.

Projections from the 1970s and 1980s seem a long time ago and one might wonder about their relevance for the present industrial reality. However, projections by these same organizations continue to this day seem to be overly optimistic.

In this context it is also important to remember that a significant share of the world’s current nuclear fleet was planned in the 1960s and 1970s. For example, all of the 104 currently operating reactors of the U.S. nuclear program were ordered between 1963 and 1973. It was this atmosphere of enthusiasm that led to a large part of the nuclear programs that are still in place today.

In 1986 the only reactor to be permanently closed was unit number 4 at Chernobyl, while 26 new reactors were connected to the grid. However, in 2011, at least 19 reactors (depending on the number of closures in Japan considered definitive) were shut down definitively, of which 18 are a direct consequence of 3/11, and only seven reactors were started up. While after Chernobyl, Germany was the first country to start up a new reactor, after Fukushima that same country shut down eight reactors. Only 14 months after 3/11, Japan does not have a single reactor operating any more—at least temporarily. Times have indeed changed.

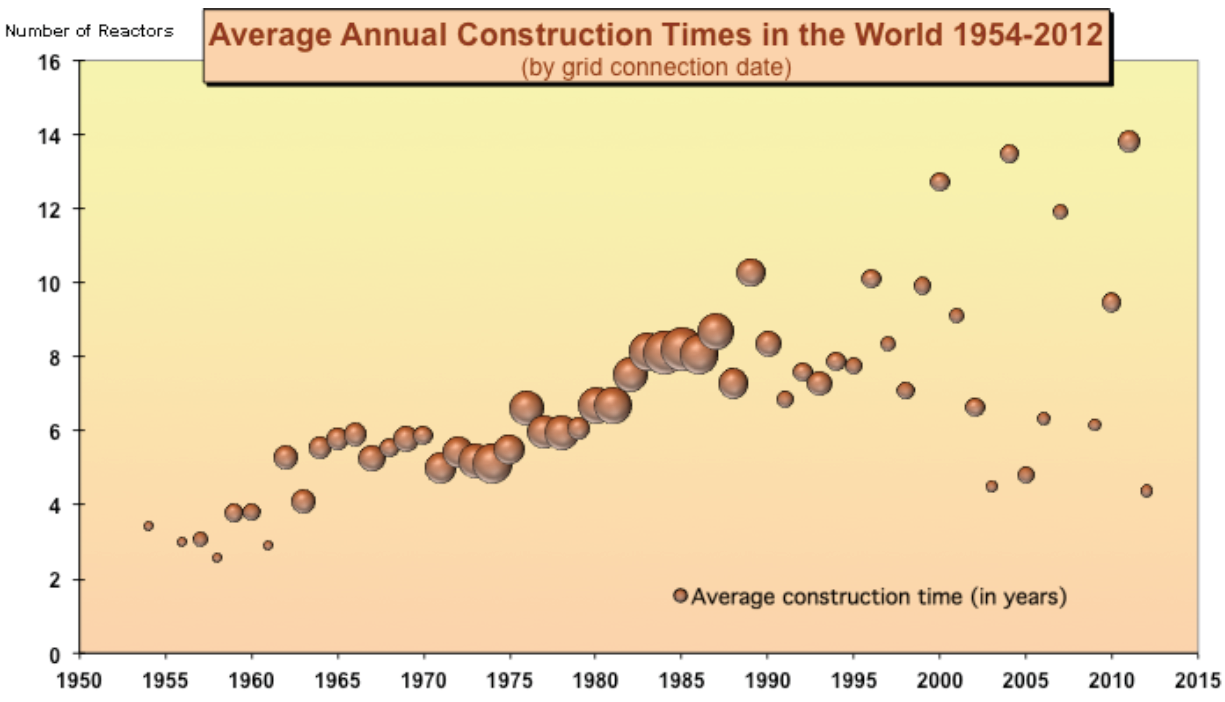

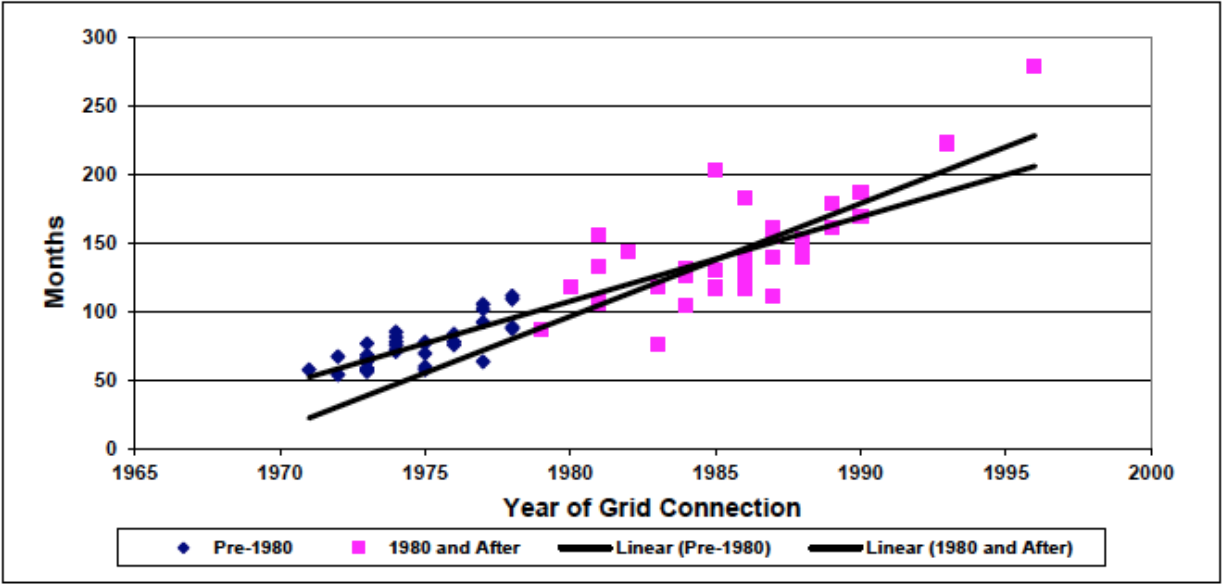

Construction Times of Past and Currently Operating Reactors ↑

There has been a clear global trend towards increasing construction times since the beginning of the nuclear age. Apparently national building programs are faster in their early years. As Figure 12 illustrates, in the 1970s and 1980s construction times were quite homogenous, while in the past two decades they have been varied. The two South Korean reactors that were connected to the grid in 2012 averaged a 4.4 year construction time, while, worldwide, it took an average of 13.8 years to build the seven units started up in 2011 and 9.5 years for the five reactors that began operating in 2010.

The reasons for gradually increasing construction times are not always well understood. It is clear that continuously increasing safety requirements and lengthy legal cases due to public opposition have played a role. Growing system complexity as a consequence of the previous conditions is also likely to have had an impact on costs.

“Forgetting by doing”, the IIASA analyst Arnulf Grübler called the phenomenon of increasing construction times and costs. [98] Most of the nuclear countries have been struck by this symptom. The latest generation of operating units provides an illustration of this. Over a 20-year period between 1992 and May 2012 a total of 89 reactors started up, accounting for about one fifth of the total operating nuclear plants (implying that four fifths are over 20 years old). Average construction time was almost nine years with a large range from 3.2 to 36.3 years. There are significant differences between the 17 countries that started up reactors during that period.

Only three countries clearly stand out with low average construction times for significant numbers of plants. With 17 units Japan started up the largest fleet over the past two decades, followed by South Korea (14), China (15) and India (13). Almost two thirds of all new startups in the world in that period were concentrated in those four countries. Average construction times in the first three countries were impressive, compared to performance in other countries. Over the past two decades, Japan averaged 4.4, South Korea 4.6 and China 5.8 years building prior to grid connection. India with 8.7 years average took twice as long as Japan to finish a reactor. (See Annex 2 for details). It is remarkable to compare this with the performance of the older large nuclear countries. The UK only started up one unit over the time period and it took 6.1 years. France started up six units after an average of 9.4 years (and a maximum of 12.6 years), Russia with five reactors after a 20 year average and the U.S. needed 18.5 and 23.2 years respectively to complete the last two units that started up in 1993 and 1996.

Figure 12: Average Annual Construction Times in the World 1954-2012

Sources: MSC based on IAEA-PRIS 2012

Note: The bubble size is equivalent to the number of units started up in the given year.